This is a summary of the recent performance of a wide range of excellent tactical asset allocation strategies. These strategies are sourced from books, academic papers, and other publications. While we don’t (yet) include every published TAA model, these strategies are broadly representative of the TAA space. Learn more about what we do or let AllocateSmartly help you follow these strategies in near real-time.

| Recent Performance of Asset Allocation Strategies Use the Arrows to Sort This Table |

||||

|---|---|---|---|---|

| MTD/YTD Return | Adjusted for Timing Luck (*) | |||

| Strategy | Apr | YTD | Apr | YTD |

| Adaptive Asset Allocation | 2.49% | 5.40% | 1.91% | 3.95% |

| Traditional Dual Momentum | 1.52% | 0.61% | 1.06% | -1.45% |

| Robust Asset Allocation – Balanced | 1.21% | 0.30% | 1.20% | 0.14% |

| Faber’s Global Tactical Asset Alloc. 5 | 1.15% | 0.54% | 1.12% | 0.29% |

| Robust Asset Allocation – Aggressive | 1.13% | 0.47% | 1.11% | 0.40% |

| Keuning’s Generalized Protective Momentum | 1.12% | 1.30% | 0.39% | 1.46% |

| Faber’s Ivy Portfolio | 1.02% | -0.95% | 1.02% | -0.95% |

| Varadi’s Percentile Channels | 0.84% | -0.10% | 0.80% | -0.94% |

| US Risk Parity Trend Following | 0.83% | 1.28% | 0.69% | 0.54% |

| Faber’s Sector Relative Strength | 0.60% | 0.45% | 0.87% | 0.65% |

| Philosophical Economics’ Growth-Trend Timing | 0.52% | -0.48% | 0.52% | -0.48% |

| Glenn’s Paired Switching Strategy | 0.32% | -0.68% | -0.04% | -1.03% |

| Faber’s Global Tactical Asset Alloc. – Agg. 3 | 0.30% | 1.77% | -0.21% | 0.55% |

| Protective Asset Allocation – CPR | 0.22% | 2.40% | 0.18% | 1.57% |

| Faber’s Global Tactical Asset Alloc. 13 | 0.18% | -0.16% | 0.11% | -0.58% |

| Flexible Asset Allocation | 0.18% | 1.60% | 0.34% | 0.13% |

| Vigilant Asset Allocation | 0.15% | 8.63% | -0.17% | 1.74% |

| Efficiente Index | 0.14% | 0.24% | 0.09% | -0.12% |

| Faber’s Global Tactical Asset Alloc. – Agg. 6 | 0.10% | 1.29% | -0.08% | 0.28% |

| Novell’s Tactical Bond Strategy | 0.05% | -2.75% | 0.03% | -2.87% |

| Global Risk Parity Trend Following | 0.03% | -0.48% | -0.22% | -0.02% |

| Allocate Smartly’s Meta Strategy | -0.04% | 0.87% | -0.04% | 0.87% |

| PortfolioCharts’ Golden Butterfly | -0.18% | -1.32% | -0.18% | -1.32% |

| 60/40 Benchmark | -0.20% | -1.48% | -0.20% | -1.48% |

| US Max Sharpe | -0.21% | -3.28% | -0.01% | -2.74% |

| Davis’ Three Way Model | -0.22% | -2.43% | -0.21% | -2.60% |

| Tactical Permanent Portfolio | -0.25% | 1.02% | -0.17% | -0.57% |

| Composite Dual Momentum | -0.25% | -3.52% | -0.00% | -2.70% |

| Classical Asset Allocation – Offensive | -0.26% | 1.13% | -0.46% | 0.87% |

| Stoken’s Active Combined Asset | -0.57% | -5.92% | -0.57% | -5.92% |

| Stoken’s Active Combined Asset – Monthly | -0.57% | -1.66% | -0.57% | -2.63% |

| Browne’s Permanent Portfolio | -0.59% | -1.18% | -0.59% | -1.18% |

| Faber’s Trinity Portfolio Lite | -0.60% | -0.34% | -0.48% | -0.49% |

| US Min Correlation | -0.60% | -2.57% | -0.64% | -2.79% |

| Dalio’s All-Weather Portfolio | -0.66% | -2.35% | -0.66% | -2.35% |

| Classical Asset Allocation – Defensive | -0.68% | 0.03% | -0.29% | 0.97% |

| US Max Diversification | -0.71% | -2.06% | -0.72% | -2.15% |

| Protective Asset Allocation | -0.74% | 1.68% | -0.64% | 0.94% |

| US Equal Risk Contribution | -0.79% | -3.11% | -0.78% | -3.21% |

| Elastic Asset Allocation – Defensive | -0.93% | -0.86% | -0.85% | -0.72% |

| Varadi’s Minimum Correlation Portfolio | -0.97% | -1.82% | -0.96% | -2.03% |

| Elastic Asset Allocation – Offensive | -0.99% | -0.83% | -0.93% | -0.88% |

Commentary:

Year to date, tactical asset allocation continues to perform, with 3 out of 4 strategies topping the 60/40 benchmark.

Year to date, tactical asset allocation continues to perform, with 3 out of 4 strategies topping the 60/40 benchmark.

Having said that, April was a fairly middling month. There were some bright spots – notably, Adaptive Asset Allocation from ReSolve Asset Management with a timely overweighting of commodities (DBC) and intl real estate (RWX), but for the most part, TAA didn’t consistently out- or under-perform the benchmark for the month. That makes sense given the cautious middle of the road asset allocation that most of these strategies are holding right now.

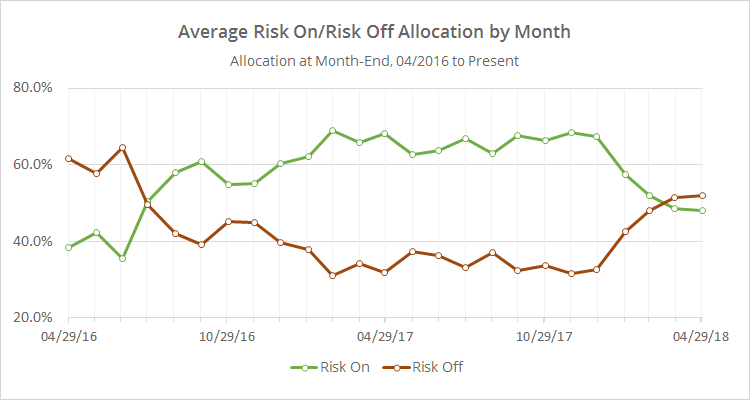

As we’ve been writing about over the last few months, TAA has been slowly de-risking in response to recent market weakness. Just four months ago, TAA’s allocation to risk assets stood near all-time highs. Today, allocation to defensive assets outweighs offensive assets.

Data Dump:

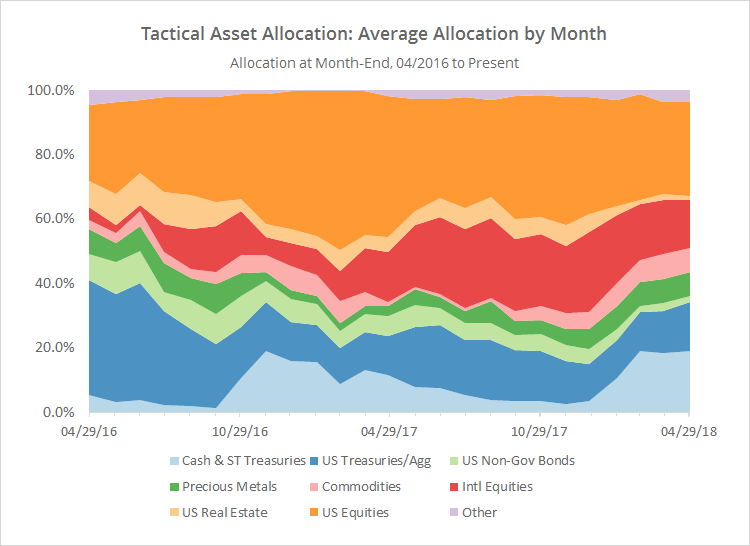

With such a large pool of published strategies to draw on (42 and counting), we’re able to draw some broad conclusions about the state of TAA. The following two charts help to show trends in the asset classes that TAA as a whole is allocating to over time.

The first chart shows the average month-end allocation to categories of assets by all of the strategies that we track. For example, “US Equities” may include everything from the S&P 500 to individual stock market sectors. Defensive assets tend to be at the bottom of the chart, and offensive at the top. The data on the far right of the chart reflects where TAA stood as of the end of the most recent month.

In the second chart below, we’ve combined average TAA allocation into even broader categories: “risk on” (equities, real estate and high yield bonds) versus “risk off” (everything else). We realize that some asset classes don’t fit neatly into these buckets, but it makes for a useful high level view.

This chart shows that allocation to defensive assets continues to outweigh allocation to offensive assets. It’s important to note, that this isn’t the same thing as risk exposure. Risk assets by their nature tend to be more volatile, so in terms of exposure, TAA is probably still in a slight “risk on” state. That’s a good thing if this bull market picks back up, but it means that there remains significant short-term risk to investors here if the market falters in May.

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and then track them in near real-time. Have questions? Learn more about what we do, check out our FAQs or contact us.