This is a summary of the recent performance of a wide range of excellent tactical asset allocation strategies. These strategies are sourced from books, academic papers, and other publications. While we don’t (yet) include every published TAA model, these strategies are broadly representative of the TAA space. Learn more about what we do or let AllocateSmartly help you follow these strategies in near real-time.

Commentary:

On average, tactical asset allocation underperformed the US 60/40 benchmark in June. US equities and bonds (the components of the 60/40 benchmark) were both strong (relatively speaking), and most diversifying asset choices failed to keep pace. Notable laggards included gold (GLD -3.6%), commodities (DBC -1.9%), and most international equity ETFs (ex. EEM -4.5% and EFA -1.6%).

On average, tactical asset allocation underperformed the US 60/40 benchmark in June. US equities and bonds (the components of the 60/40 benchmark) were both strong (relatively speaking), and most diversifying asset choices failed to keep pace. Notable laggards included gold (GLD -3.6%), commodities (DBC -1.9%), and most international equity ETFs (ex. EEM -4.5% and EFA -1.6%).

Most of the tactical asset allocation strategies that we track employ some variation of trend-following/momentum, so it’s unsurprising that TAA has shifted to a very US-centric asset allocation in response to this continued international weakness. See the data dump below.

Data Dump:

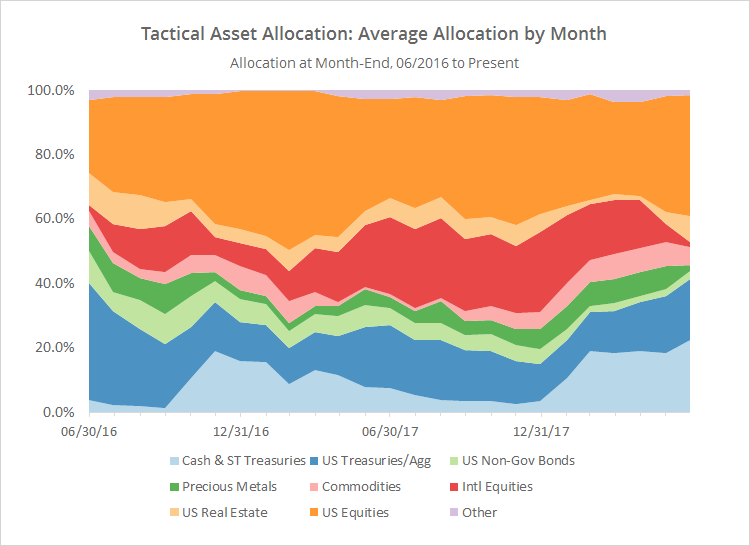

With such a large pool of published strategies to draw on (42 and counting), we’re able to draw some broad conclusions about the state of TAA. The following two charts help to show trends in the asset classes that TAA as a whole is allocating to over time.

The first chart shows the average month-end allocation to categories of assets by all of the strategies that we track. For example, “US Equities” may include everything from the S&P 500 to individual stock market sectors. Defensive assets tend to be at the bottom of the chart, and offensive at the top. The data on the far right of the chart reflects where TAA stood as of the end of the most recent month.

Note how international equity exposure (dark red) has collapsed from a recent high of 25% to start the year, to less than 2% today.

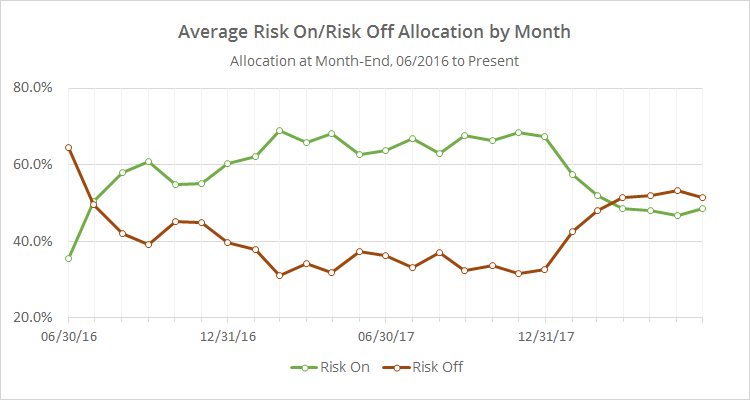

In the second chart below, we’ve combined average TAA allocation into even broader categories: “risk on” (equities, real estate and high yield bonds) versus “risk off” (everything else). We realize that some asset classes don’t fit neatly into these buckets, but it makes for a useful high level view.

This chart shows that TAA remains split fairly evenly between offensive and defensive assets. An even longer view shows that we’re nowhere near historical highs, but TAA continues to signal a degree of caution towards this market.

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and then track them in near real-time. Have questions? Learn more about what we do, check out our FAQs or contact us.