This is a summary of the recent performance of a wide range of excellent tactical asset allocation strategies. These strategies are sourced from books, academic papers, and other publications. While we don’t (yet) include every published TAA model, these strategies are broadly representative of the TAA space. Learn more about what we do or let AllocateSmartly help you follow these strategies in near real-time.

Commentary:

It was a strong start to the new year for tactical asset allocation. As was the case for all of last year, TAA was generally positioned offensively to start the month. Some key outperforming asset classes like emerging market equities (ex. EEM +8.3%) were overweighted, and some key underperformers like US Treasuries (IEF -2.2%, TLT -3.3%) underweighted.

It was a strong start to the new year for tactical asset allocation. As was the case for all of last year, TAA was generally positioned offensively to start the month. Some key outperforming asset classes like emerging market equities (ex. EEM +8.3%) were overweighted, and some key underperformers like US Treasuries (IEF -2.2%, TLT -3.3%) underweighted.

Surprisingly given the strength of January’s results however, TAA began rolling back risk exposure at the end of the month. See below.

Data Dump:

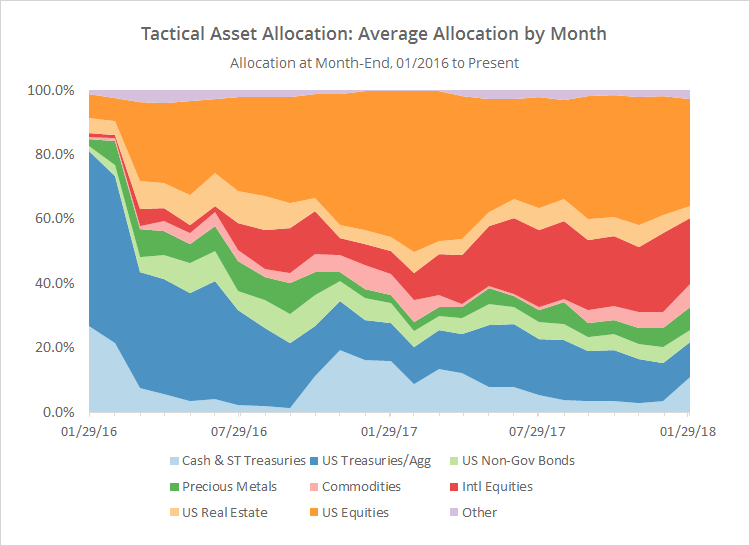

With such a large pool of published strategies to draw on (40 and counting), we’re able to draw some broad conclusions about the state of TAA. The following two charts help to show trends in the asset classes that TAA as a whole is allocating to over time. Members note that you can see this information updated daily with our Aggregate Asset Allocation report.

The first chart shows the average month-end allocation to categories of assets by all of the strategies that we track. For example, “US Equities” may include everything from the S&P 500 to individual stock market sectors.

The important takeaways from this chart: TAA is still generally postured offensively relative to history (click for a longer view), but has begun reducing that exposure in a significant way for the first time since late-2006. It’s a little hard to suss that out from this chart, but it will become clearer in the follow up.

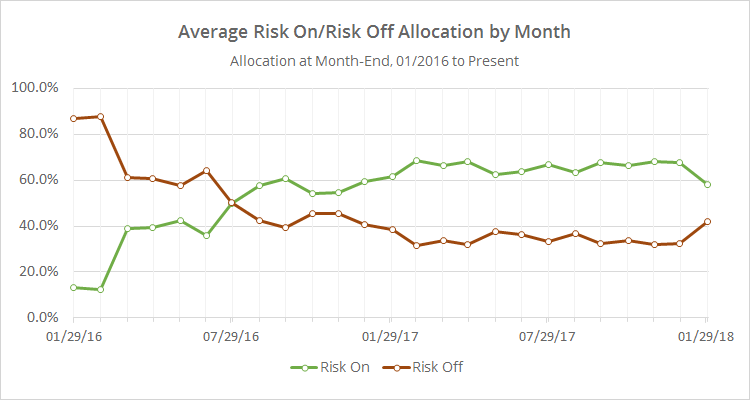

In the second chart below, we’ve combined average TAA allocation into even broader categories: “risk on” (equities, real estate and high yield bonds) versus “risk off” (everything else). We realize that some asset classes don’t fit neatly into these buckets, but it makes for a useful high level view.

This chart shows that while overall allocation to risk assets remains elevated relative to history (click for a longer view), TAA has backed off of the highs of the last year. Having said that, risk is still high. That’s a good thing if this broad rally continues, but it means that there remains significant exposure to investors here if the market stumbles in February.

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and then track them in near real-time. Have questions? Learn more about what we do, check out our FAQs or contact us.