This is a summary of the recent performance of a wide range of excellent tactical asset allocation strategies. These strategies are sourced from books, academic papers, and other publications. While we don’t (yet) include every published TAA model, these strategies are broadly representative of the TAA space. Learn more about what we do or let AllocateSmartly help you follow these strategies in near real-time.

Commentary:

Most risk asset classes (like equities) turned in a strong performance in October, while most defensive asset classes (like treasuries) were weak to middling. As a result, concentrated strategies (which are generally positioned offensively at the moment due to recent market strength) tended to outperform, and more diversified strategies to underperform.

Most risk asset classes (like equities) turned in a strong performance in October, while most defensive asset classes (like treasuries) were weak to middling. As a result, concentrated strategies (which are generally positioned offensively at the moment due to recent market strength) tended to outperform, and more diversified strategies to underperform.

There were some notable exceptions among major asset classes: commodities, generally viewed as a defensive asset, were strong (ex. DBC +3.96%), while anything related to real estate, generally viewed as a risk asset, was weak (ex. VNQ -1.07% and REM -2.97%).

Data Dump:

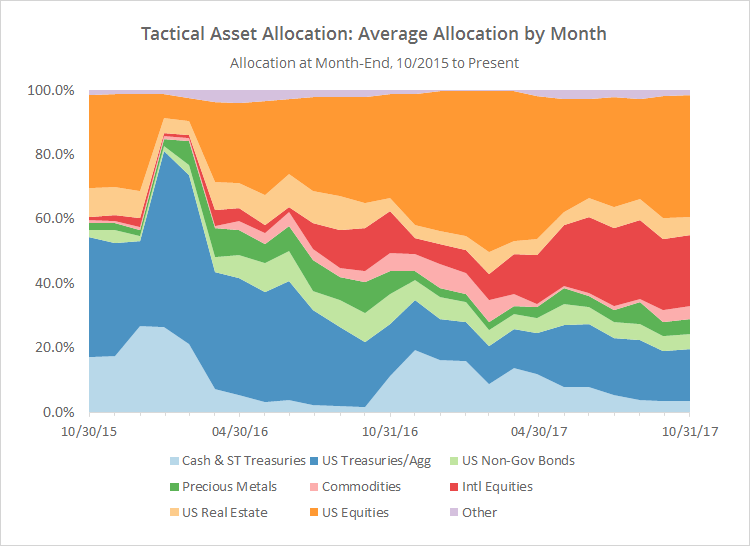

With such a large pool of published strategies to draw on (40 and counting), we’re able to draw some broad conclusions about the state of TAA. The following two charts help to show trends in the asset classes that TAA as a whole is allocating to over time. Members note that you can now see this information updated daily with your new Aggregate Asset Allocation report.

The first chart shows the average month-end allocation to categories of assets by all of the strategies that we track (click for a longer view). For example, “US Equities” may include everything from the S&P 500 to individual stock market sectors.

Two important takeaways from this chart: TAA’s exposure to defensive assets like cash (light blue) and US Treasuries (dark blue) remains near it’s lowest point since early 2007, and exposure to international equities (red) remains near it’s highest point since late 2012. TAA is positioned aggressively, which will become more clear in the follow up charts.

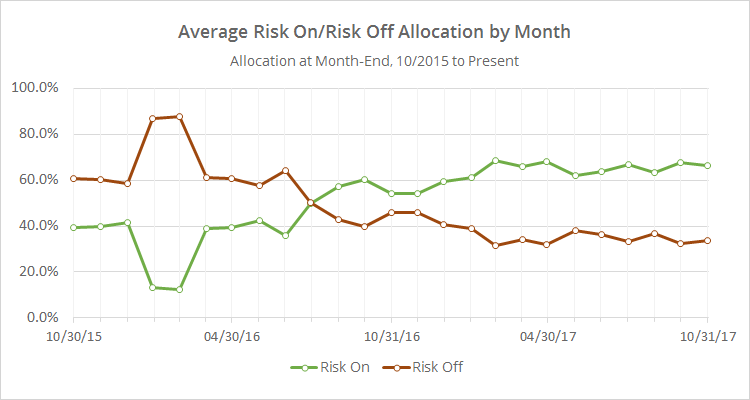

In the second chart below, we’ve combined average TAA allocation into even broader categories: “risk on” (equities, real estate and high yield bonds) versus “risk off” (everything else). I realize that some asset classes don’t fit neatly into these buckets, but it makes for a useful high level view.

This chart shows that overall allocation to risk assets remains elevated. The last time TAA’s exposure to risk assets stood at these levels was way back in 2007, about 6 months prior to the onset of the Global Financial Crisis (click for a longer view). That’s a good thing if this broad rally continues, but it means that there remains significant exposure to investors here if the market stumbles in November.

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and then track them in near real-time. Have questions? Learn more about what we do, check out our FAQs or contact us.