New to Tactical Asset Allocation? Skip to: What is TAA?

What is Tactical Asset Allocation (TAA)?

Tactical Asset Allocation (TAA) strategies invest in broad asset classes like stock indices (ex. SPY), bond indices (AGG), and gold (GLD). Unlike buy & hold, TAA strategies dynamically adjust the portfolio’s asset allocation to maximize return and minimize losses.

TAA strategies tend to trade once a month or less, capturing major market trends and ignoring day-to-day noise. That makes them easy to follow for traders who refuse to be glued to a monitor all day.

The concepts underpinning TAA have proven effective for decades, and in most cases, centuries. Most strategies employ some version of momentum and trend-following. These are not fleeting anomalies that are here today and gone tomorrow. They are fundamental market forces that have worked for as long as financial markets have existed.

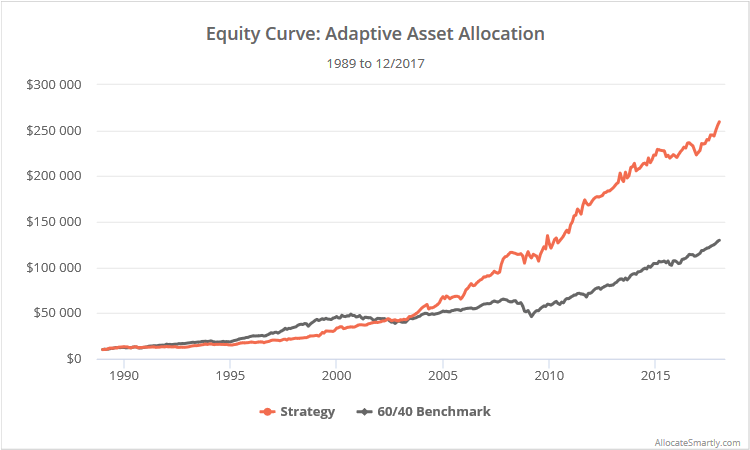

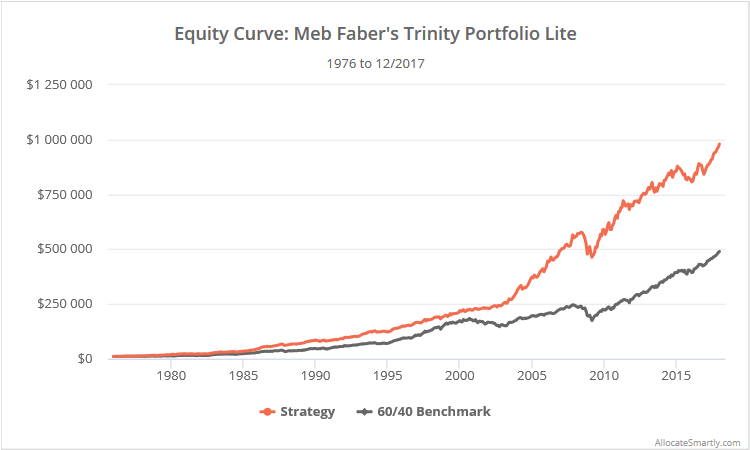

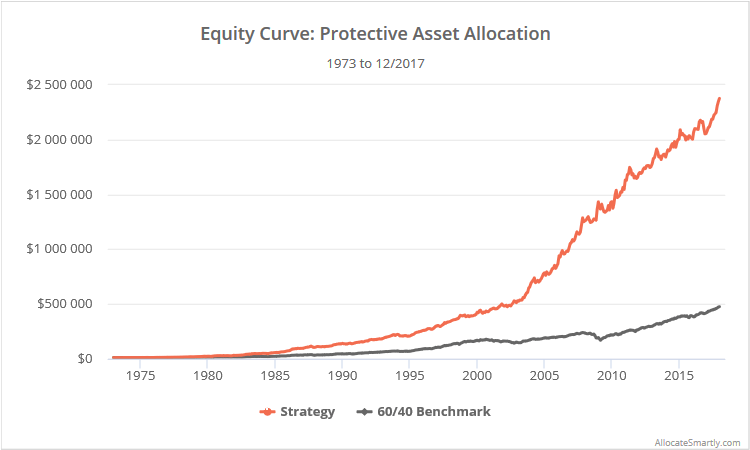

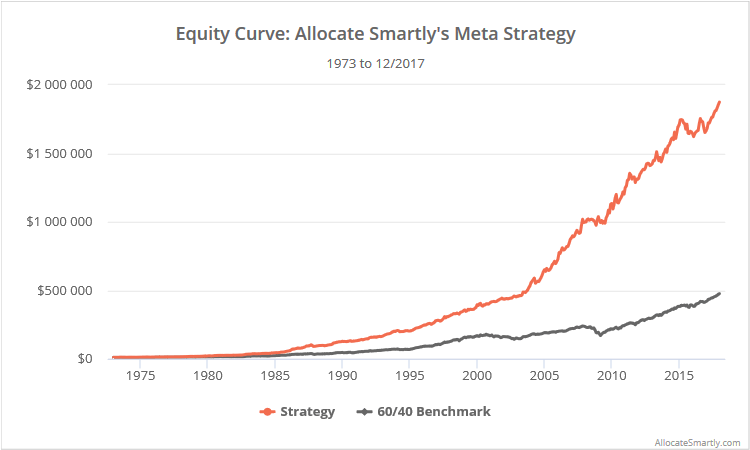

Below we’ve shown just some examples of the TAA strategies included in the full list of strategies that we track.

We track dozens of the industry’s very best Tactical Asset Allocation strategies, sourced from books, academic papers and other publications. Organizing all of these different models, analyzing them on a level playing field, and then implementing them in the real-world would be unmanageable. That’s where we come in.

Our platform helps members to analyze each strategy with thorough, up to date backtests. Members can then combine multiple strategies together to create their own custom Model Portfolios. Combining strategies in this way reduces the risk of any single strategy going off the rails and helps to provide smoother, more consistent investment returns. On top of all of that, we provide a number of advanced features to help members take their analysis of TAA to the next level.

All of the strategies that we track are both quantitative and systematic, meaning well-defined mathematical rules govern exactly when and what to trade. We assume that all strategies trade at the market close (read more about when we trade), and that trades are executed using large, liquid ETFs (read more about what we trade), but because of the long-term nature of these strategies, most have performed comparably trading at similar times (ex. the next day’s open) or using similar assets (ex. mutual funds).

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Have questions? Please check out our FAQs or contact us.