Tactical Asset Allocation (TAA) weathered the storm in February and March, significantly paring down losses vs conventional buy & hold. So far it has trailed the bounce in April, but these are early days.

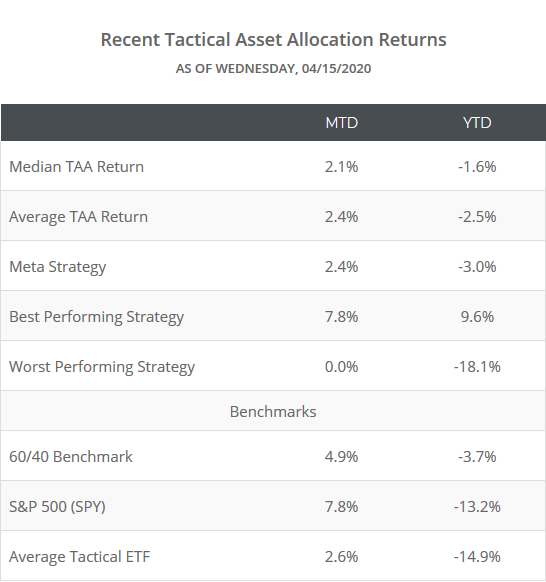

We track 50+ TAA strategies sourced from books, papers, etc., allowing us to draw some broad conclusions about TAA as a style. In the table below we show the MTD and YTD returns of these 50+ strategies:

All 54 strategies are up MTD and 21 out of 54 are up for the year. For a more in depth look at TAA’s current asset allocation, see our previous post.

How we got here (all data as of Wednesday, 04/15):

- TAA began reducing exposure to risk assets in January and February, and entered March averaging a 76% allocation to defensive assets like treasuries and gold.

- As a result, TAA significantly pared down losses in March vs a conventional buy & hold portfolio (read more). The median TAA strategy lost just -1.0%, vs -6.0% for the benchmark.

- TAA entered April positioned even more defensively, averaging an 86% allocation to defensive assets. Risk assets have rallied in the first half of the month, leaving the median strategy up but trailing (2.1% vs 4.9%). Year to date TAA continues to outperform.

Despite the underperformance so far in April, I feel comfortable with TAA’s current defensive posture. Could I see being a bit more aggressive than the average model on our site? Sure, depending on your faith in this grand stimulus experiment. Could I see taking on significant risk here? No way.

These are early days, and while TAA may end up being wrong in the near-term, now is not the time to be a cowboy. This tweet sums up my view perfectly: “Get your risk right. Uncertainty is high, thus price discovery is low, thus confidence should be tempered. This is no time for big bold bets.”

We’ll check back in on TAA performance at month-end. Also, expect a new strategy from a popular asset allocation site that many of you know and love to be released next week.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and follow them in near real-time. Not a DIY investor? There’s also a managed solution. Learn more about what we do.