This is a summary of the recent performance of a number of excellent tactical asset allocation strategies. These strategies are sourced from books, academic papers, and other publications. While we don’t (yet) include every published TAA model, these strategies are broadly representative of the TAA space. Read more about our backtests or let AllocateSmartly help you follow these strategies in near real-time.

Commentary:

There was a wider-than-usual disparity in the performance of significant asset classes in November. Essentially anything related to US equities was strong, including the S&P 500 (represented by SPY, +3.7%) and Russell 2000 small-caps (IWM, +11.1%). Most asset classes however were down for the month, particularly gold (GLD, -8.4%), long-term US Treasuries (TLT, -8.2%) and emerging markets (EEM, -4.4%).

A number of the more aggressive strategies that we track capitalized on those strong US equity returns. It was the more cautious strategies, that lay bets across more traditionally defensive assets like Treasuries and gold, that struggled for the month.

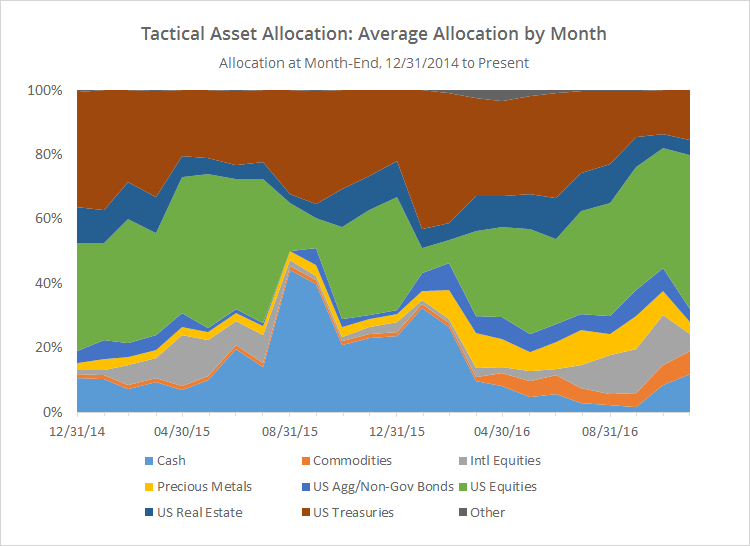

The strategies have, as a whole, responded by increasing allocation to US equities. The chart below shows the average allocation to broad categories of assets by the 23 strategies that we track, as of the end of each month since EO’2014. Note that allocation to US equities (green) has reached a sample high of 48%. In other words, on average, the strategies that we track are currently nearly half allocated to some flavor of US equities.

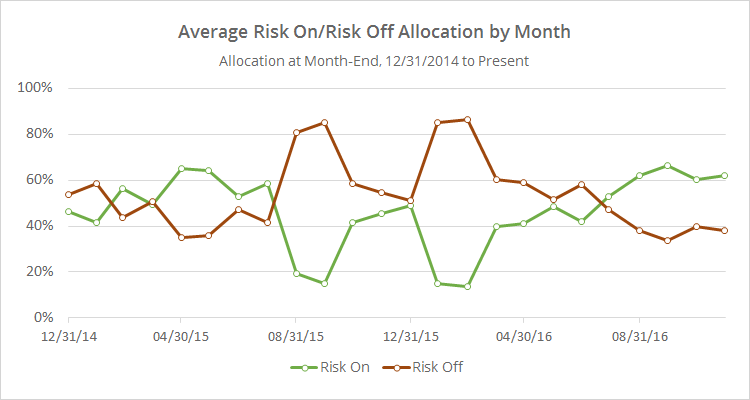

Despite these recent changes to allocation however, the overall exposure to risk on/risk off assets has remained essentially the same over the last four months. To illustrate, below I’ve combined asset classes into even broader categories: “risk on” (equities, real estate and high yield bonds) versus “risk off” (everything else). I realize that some asset classes don’t fit neatly into these buckets, but it makes for a useful high level view.

As previously mentioned, while we don’t (yet) track every published tactical asset allocation model, the 23 strategies that we do track are broadly representative of the TAA space, and I think it’s fair to draw some broader conclusions from this data. Tactical asset allocation overall remains bullish on risk, but there is significant exposure to investors here if the market softens in December.

Coming soon:

Many of the strategies that we track are related to some flavor of momentum trading. We want to make sure that we’re maintaining balance on this site, so we’ll be adding a suite of very different strategies focused on portfolio optimization techniques: Min Variance, Min Correlation, Max Diversification, Equal Risk Contribution and Max Sharpe. Be on the lookout for these new strategies over the next week.