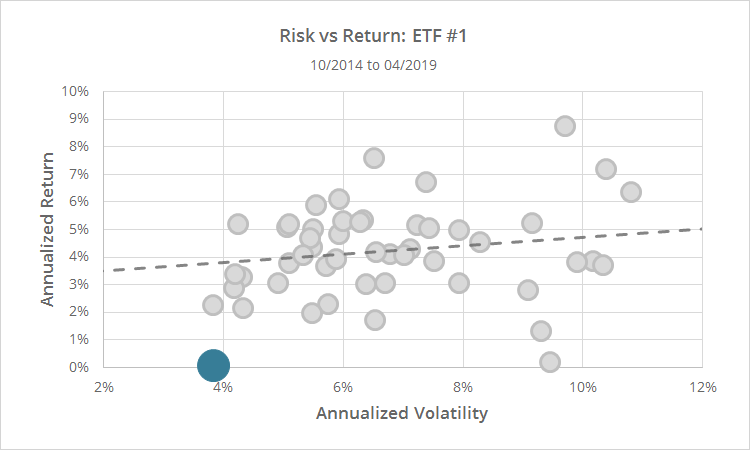

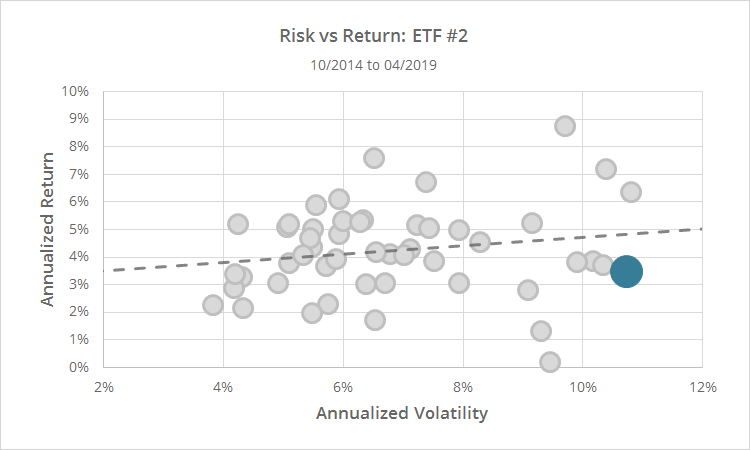

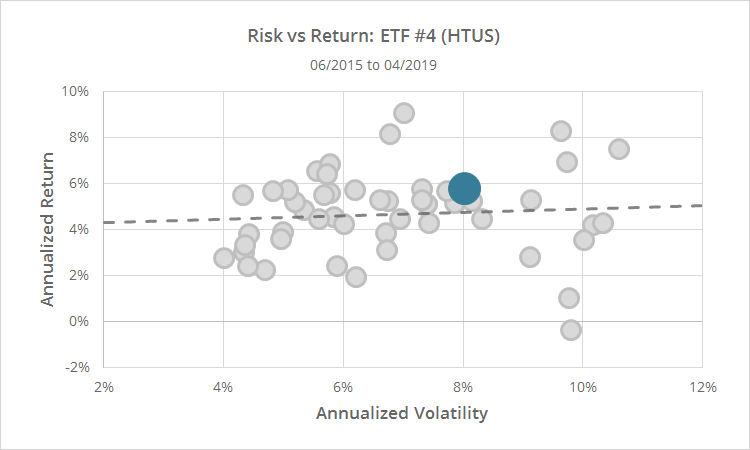

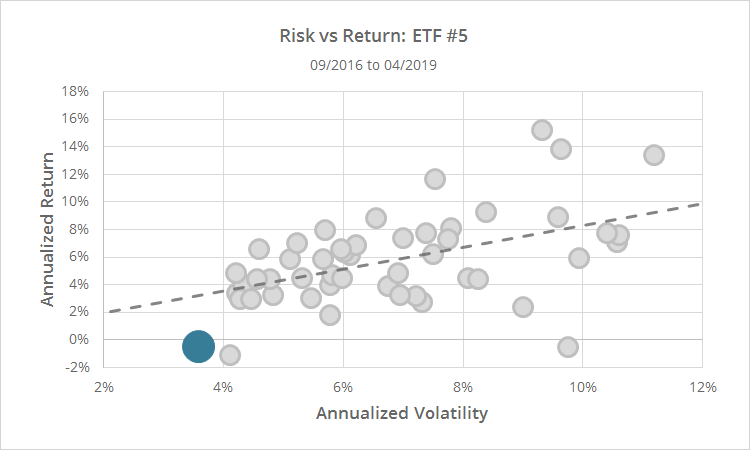

In this post we compare the performance of the 49 tactical asset allocation strategies that we track to 6 ETFs that provide all-in-one exposure to TAA.

We were inspired by James Picerno’s Capital Spectator to run this analysis, so we’ve appropriated his list of 6 ETFs. Of the 6 ETFs, only one has provided results in the neighborhood of the public strategies: Hull Tactical’s HTUS (ETF #4). The remainder have lagged, sometimes badly.

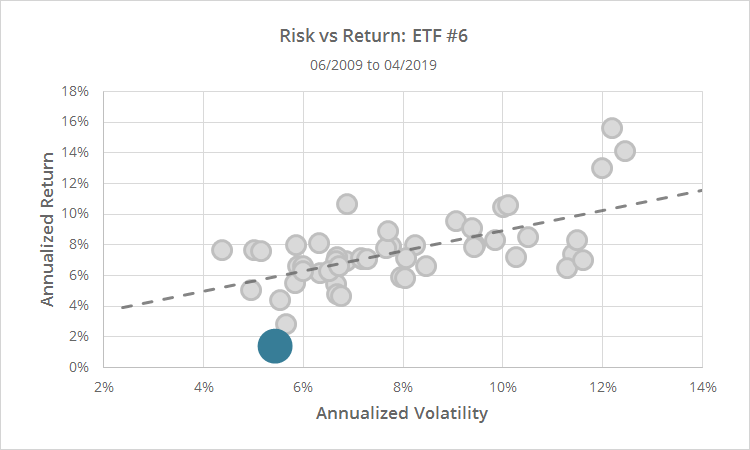

A data dump follows, one chart per ETF. ETF results are in blue, public strategies in grey. See backtest assumptions. Like James, we’ve held back the identities of the ETFs, except for the one that turned in strong results. The performance of the public strategies is for the same overlapping period as the ETF in question. The dotted line is a linear regression of return vs volatility. Strategies above the dotted line have generated higher returns per unit of risk than those below it.

Why the underpeformance? The ETF expense ratio is definitely a big factor. Trading limitations due to fund size might be another. Next best guess: the tendency towards (1) unnecessary complexity, and (2) discretionary second guessing, that’s inherent in trading proprietary signals. There’s also a bit of overlap with some of these strategies’ in-sample history, which should be considered.

Learn about what we do or let AllocateSmartly help you follow these strategies in near real-time.

Edit: In the first iteration of this post, I added Meb Faber’s GAA to the list (ETF #3), wrongly thinking that it was akin to Faber’s GTAA (a tactical strategy). I was incorrect, it’s a B&H strategy. Whoops, I should have stuck with James’ original list.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and then track them in near real-time. Have questions? Learn more about what we do, check out our FAQs or contact us.