Here are some things we know about Tactical Asset Allocation: (Learn more: What is TAA?)

- We shouldn’t go 100% “all in” on just one TAA strategy. That introduces “specification risk”, or the risk that we’ve bet on an underperforming horse. Instead, we should combine multiple strategies together into what we call Model Portfolios.

- When trading a diversified combination of TAA strategies, we could delay the execution of trades by a full day (i.e. trade today’s signal tomorrow) with little impact on long-term results. Read more. That’s the first way investors can make things easier on themselves.

-

There’s another way investors can make things easier on themselves too: by “rolling up” small positions into more generic asset classes.Sometimes when we combine many strategies, we end up with some small positions of say 5-10% of the portfolio, or less. By rolling up these small positions into more generic classes, we have less trades to manage. Importantly, this would have had little impact on long-term performance on a risk-adjusted basis (that detail is important…more in a moment).

The test:

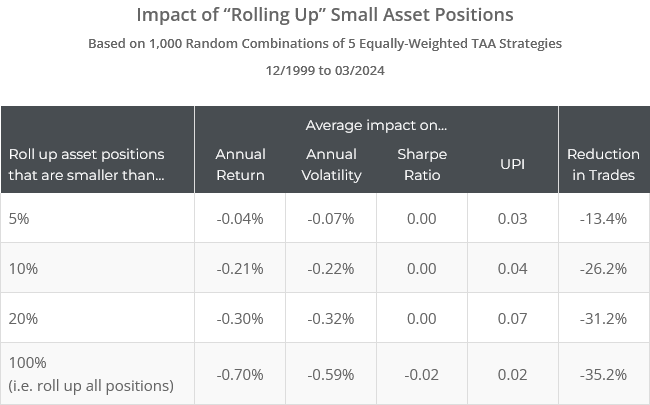

We created 1,000 portfolios of 5 TAA strategies randomly selected from the 80+ strategies we track (*). 20% of each portfolio was allocated to each strategy. We then assumed an investor followed the combined portfolio using various approaches to dealing with small positions.

In approaches #1-3, combined positions that were smaller than 5%, 10% or 20% of the total portfolio, were rolled up into a more generic asset class. For example, a small position in US small caps would roll up into US large caps. In approach #4, we rolled up all positions into more generic asset classes. Later in this post we provide a complete list of those generic asset classes.

Results from 12/1999 follow. Note that all tests include our usual transaction cost assumptions.

Here are the takeaways:

- As one would expect, the more liberal the threshold for rolling up small positions, the less total trades were required.

-

As the threshold for rolling up small positions increased, annualized return fell, but so did volatility by a roughly equal degree.That makes sense. These small positions tend to be in more niche assets (think “US small cap value” as opposed to simply “US stocks”). These niche assets may provide higher return potential (after all, there’s a reason the strategy picked that specific asset), but niche assets also tend to come with additional volatility compared to a broader index.There was also a reduction in portfolio turnover and subsequently, transaction costs. More on this later.

- In terms of risk-adjusted performance (Sharpe and UPI), there was almost no impact to rolling up small positions. In other words, return decreased, but so did risk, so that on a risk-adjusted basis it was a wash.

The overall conclusion: Make things easier on yourself.

Rolling up small positions into more generic asset classes will likely have little impact on long-term risk-adjusted performance. We think a 5% cutoff is a no brainer, with almost no impact on performance. A 10% or even 20% threshold begins to have a larger impact, but also comes with a bigger reduction in trades, and we think could still make sense for many investors.

Side note: None of this should be too surprising. These results agree with our previous analysis looking at aggregate TAA performance in terms of individual asset classes versus asset class “categories”.

A list of generic asset classes:

Below we list all asset classes covered on our platform. To make the list more readable, we show the ETF used to represent the asset class on our platform rather than the asset class name (read more).

The “generic” asset class is listed first in bold, and asset classes with the potential to roll up into it are listed after. We never rolled up the generic asset class, even when it fell below the small position threshold.

- US Large Cap Stocks (SPY): IWD, IWF, IWM, IWN, IWO, MTUM, QQQ, SCHD and all individual stock market sectors except XLRE

- International Stocks (EFA): EEM, EFV, EWJ, RWX, SCZ, VGK

- US Real Estate (VNQ): REM, RWO, XLRE

- US Corporate Bonds (LQD): HYG

- US Int-term Treasuries (IEF): BWX, EMB, TIP, TLT

- Commodities (PDBC): none

- Gold (GLD): none

- Cash: AGG, BNDX, SHY

For example, if our position in IWN (US Small Cap Value) was below our position size threshold, we would roll that allocation up into SPY (US Large Caps). If our position in EFV (Intl Small Cap Value) was below our threshold, it would roll up into EFA (International Stocks).

Why this works:

TAA tends to focus on a monthly timeframe, ignoring intramonth noise.

Over the course of a month, a niche asset’s performance can be mostly explained by the broader, more generic asset class. Risk assets tend to move together, as do bond assets. There will be differences, but when a niche position is very small, it’s harder for those differences to move the portfolio in a significant way.

Also, as previously noted, niche assets tend to be more volatile, and by rolling up small positions, we tend to reduce overall volatility.

Importantly, this analysis only applies to a diversified combination of TAA strategies. If trading a single strategy, rolling up small positions could have a much larger impact on results.

Lastly (warning: this will get a little geeky)…

We saw a decrease in the number of trades of between 13% and 35% depending on where we set our small position threshold. There would have been some decrease in portfolio turnover as well, but not to the same degree.

The changes in position are still going somewhere, so turnover isn’t so drastically reduced, but there’s a greater chance of trades “cancelling each other out” (ex. one strategy is selling SPY, while another strategy is buying SPY), so there was some reduction in turnover. That reduction is baked into these results because we use a turnover-based transaction cost assumption.

If an investor’s transaction costs were instead based on the number of trades, the positive benefit of rolling up small positions would have been even greater. If an investor’s transaction costs were less than those we model, the benefit would have been less, or even negative.

Don’t underestimate transaction costs, even if trading at a transaction cost-free broker. Remember, when we say “transaction costs”, what we really mean is “trading frictions”. That includes slippage, which almost all investors incur.

In summary:

When combining multiple TAA strategies into a Model Portfolio, consider rolling up small positions into more generic asset classes. The data provided in this analysis can help investors determine the threshold for what constitutes a “small position”.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free membership. Put the industry’s best Tactical Asset Allocation strategies to the test, combine them into your own custom portfolio, and follow them in real-time. Learn more about what we do.

* * *

Calculation notes:

- To make this analysis more manageable, we excluded the 5 strategies we track that are categorized as daily strategies. We only drew from monthly/static strategies when creating our 1,000 random Model Portfolios. We see no reason to think these results would be any different had those 5 strategies been included.

- We did not account for Alternate Trading Days for monthly strategies, and assumed all trades were executed at the month-end close.

- A geeky detail: We count a “trade” when there was a change in optimal allocation. As a rule, we assume Model Portfolios were rebalanced monthly, even if there was no change in optimal allocation. These rebalances affect portfolio turnover (and transaction costs), but do not affect the number of trades unless accompanied by a change in optimal allocation. Read more and more. All of that is just a geeky clarification and does not affect the results presented in this analysis.