We enjoy hearing from members about their experiences using our platform to analyze and combine tactical asset allocation strategies. We do a bad job of sharing that feedback with other members, and that’s a shame, because there’s often a lot of wisdom in it. So let’s change that.

What follows is an email from member Mark demonstrating the benefit of combining strategies not just on historical performance (which I think everyone grasps the benefit of), but also in reducing “timing luck”. Timing luck describes the randomness that is introduced simply by the day of the month that an investor chooses to trade a monthly strategy. This is an “uncompensated” risk that we usually recommend managing by diversifying across trading days (i.e. portfolio tranching), but as Mark demonstrates, combining strategies in and of itself has a marked effect on timing luck.

Walter,

Rainy afternoon stuff here. Wanted to see the impact of combining several strategies with different methods and look-back periods on trading day luck. It’s pretty impressive. Just did an equal weight to four solid strategies that take different approaches without even looking at correlations:

Adaptive Asset Allocation

Kipnis’ Defensive Adaptive Asset Allocation

Newfound’s Diversified Dual Momentum

Protective Asset Allocation – CPR

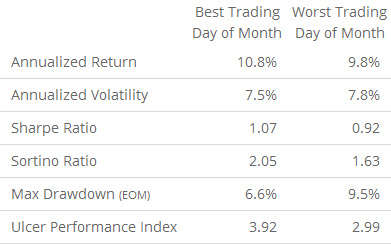

No surprise, the results were impressive. However, when I did the combined TAA for each day of the month, it was pretty cool. The trading day luck drops dramatically. Here’s the best day vs worst for various metrics 1990 to present:

Now, compare that to Adaptive Asset Allocation from 1989 to present (very similar timeframe)

Of course, the first thing that you notice is how much better the combined TAA numbers are. But trading day luck in particular drops dramatically. People who aren’t combining strategies are missing out on a huge benefit of your site.

Anyway, I’m sure that you’ve done this analysis yourself only using much more sophisticated methods, but I just have to do things like this – even simple things – to really believe in a strategy.

Best,

Mark

The key takeaway is not the improved historical performance of the combined portfolio; that’s to be expected (and quite frankly, you’d have to be silly not to take advantage of that low hanging fruit). The key takeaway is the simultaneous reduction in “timing luck”, or the randomness that we inject into our portfolio just based on the (mostly arbitrary) day we opt to execute trades.

Our members often do a better job of advocating for our service than we do. A mighty big thank you to Mark for the contribution.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and then track them in near real-time. Have questions? Learn more about what we do, check out our FAQs or contact us.