This is a summary of the recent performance of a number of excellent tactical asset allocation strategies. These strategies are sourced from books, academic papers, and other publications. While we don’t (yet) include every published TAA model, these strategies are broadly representative of the TAA space. Read more about our backtests or let AllocateSmartly help you follow these strategies in near real-time.

Commentary:

Tactical asset allocation turned in another strong performance in February, with positive results across the board MTD and YTD. It was hard to go horribly wrong, with most significant asset classes up for the month. Notable winning assets included US equities (ex. SPY +3.9% and QQQ +4.4%) and US real estate (VNQ +3.5% and REM +5.7%). The lone significant losing asset class was diversified commodities (DBC -0.2%).

Tactical asset allocation turned in another strong performance in February, with positive results across the board MTD and YTD. It was hard to go horribly wrong, with most significant asset classes up for the month. Notable winning assets included US equities (ex. SPY +3.9% and QQQ +4.4%) and US real estate (VNQ +3.5% and REM +5.7%). The lone significant losing asset class was diversified commodities (DBC -0.2%).

My commentary over the last few months has remained essentially the same: the strategies that we track remain bullish on risk, and are now bumping up against historical high levels of exposure to risk assets.

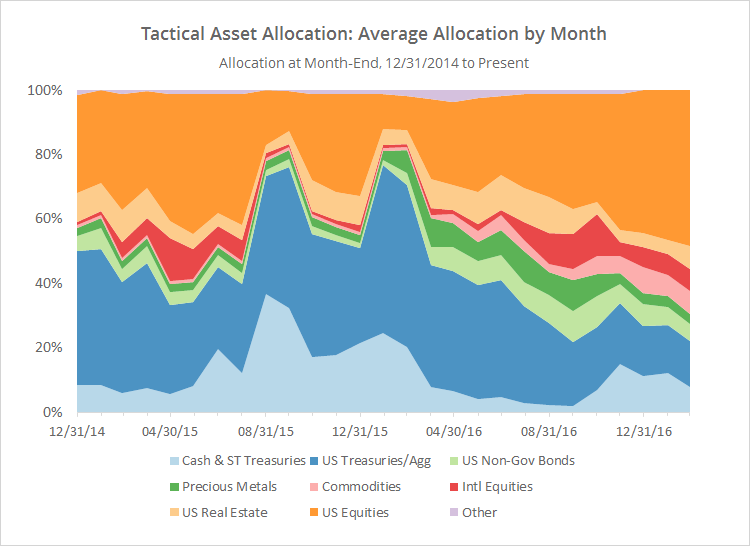

To illustrate, the chart below shows the average allocation to broad categories of assets by the 31 strategies that we track, as of the end of each month since EO’2014 (for a longer view, see this post). For example, “US Equities” may include everything from the S&P 500 to individual stock market sectors.

Note that allocation to US equities is now at a sample high of 49%, meaning that, on average, the strategies that we track are currently nearly half allocated to some flavor of US equities. Conversely, allocation to US Treasuries is now at a sample low of 14%.

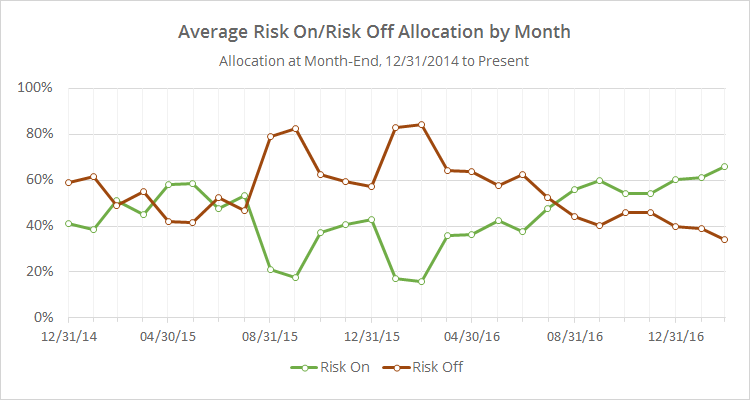

Below I’ve combined asset classes into even broader categories: “risk on” (equities, real estate and high yield bonds) versus “risk off” (everything else). I realize that some asset classes don’t fit neatly into these buckets, but it makes for a useful high level view. This simplified chart tells the story more clearly. Looking even further into history, we’re at the highest levels of exposure to risk assets since mid-2007.

As previously mentioned, while we don’t (yet) track every published tactical asset allocation model, the 31 strategies that we do track are broadly representative of the TAA space, and I think it’s fair to draw some broader conclusions from this data. Tactical asset allocation overall remains very bullish on risk, but there is significant exposure to investors here if the market stumbles in March.

We invite you to become a member for less than $1 a day or take our platform for a test drive with a free limited membership. Track the industry’s best tactical asset allocation strategies in near real-time, and combine them into custom portfolios. Have questions? Learn more about what we do, check out our FAQs or contact us.