Fair warning: this article is intended for advanced DIY Tactical Asset Allocation investors, i.e. nerds like us.

First, a bit of background knowledge you’ll need to understand this discussion…

Background knowledge: What is “timing luck”?

Most Tactical Asset Allocation (TAA) strategies trade just once per month. Strategy developers almost always assume trades are executed on the last trading day of the month (read why).

A unique feature of our platform is the added ability to follow these strategies on any other day of the month. We’re not simply executing the same signal on other dates; we’re recalculating the strategy’s entire position, while maintaining the integrity of the original strategy (read more).

Strategy performance can vary widely depending on the day of the month when trades are executed. This variability, which is due largely to chance, is called “timing luck”.

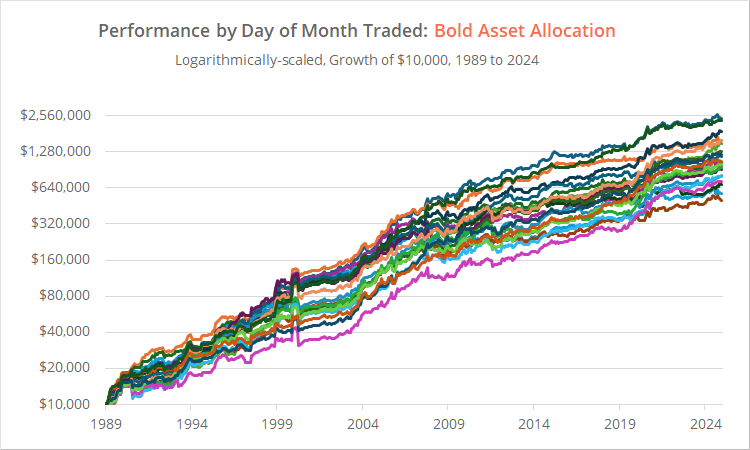

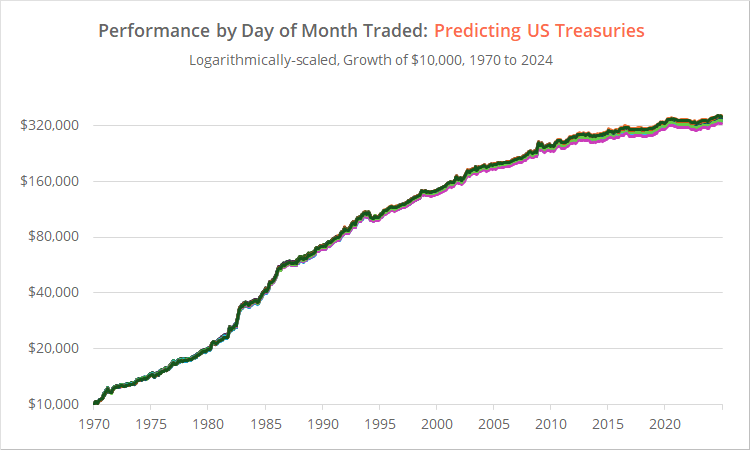

Some strategies are more sensitive to timing luck than others. For two extreme examples, look at how much performance differs based on the day of the month traded for Bold Asset Allocation (highly sensitive to timing luck) versus Predicting US Treasury Returns (not sensitive to timing luck).

Background knowledge: Two antidotes to timing luck

If a strategy is very prone to timing luck, we can limit timing luck to an acceptable level in two ways (both of which are supported by your Model Portfolios).

- Spread the portfolio across multiple strategies. Some of the timing luck of the individual strategies cancels out, because this strategy zigs when that strategy zags.

- Add additional “tranches” to strategies that are particularly sensitive to timing luck. This means splitting the execution of these strategies across multiple days of the month. We’re executing trades more often, but with smaller portions of the portfolio.

Both approaches are part of the “what, when and how” of diversification. When combining strategies, we diversify across the “how”. When adding additional tranches, we diversify across the “when”.

Side note: Tranching versus simply trading the strategy more often

Rather than splitting the strategy’s allocation across trading days (i.e. tranching), why not simply execute the entire strategy position multiple times throughout the month? In other words, why not turn a monthly strategy into a weekly or semi-monthly strategy?

As we’ve covered previously, this has been a suboptimal approach. These strategies are “tuned” to that monthly cadence. It allows them to ignore short-term noise and reduce whipsaw. Tranching maintains that monthly cadence, but trading the entire strategy multiple times per month does not.

A new member report: Taming Excessive Timing Luck

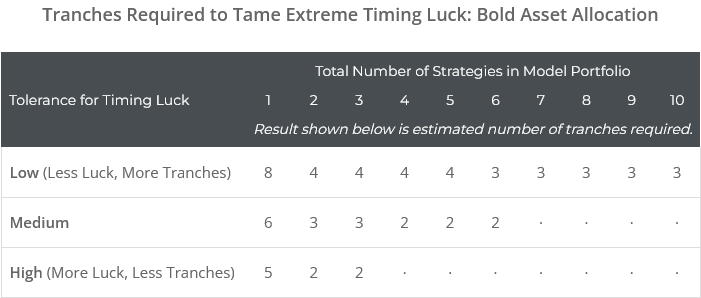

We’ve added a new report to the members area estimating the number of tranches required to tame excessive timing luck in each strategy based on two inputs:

- The total number of strategies in the Model Portfolio (because, as discussed, diversifying across strategies itself reduces timing luck).

- The investor’s “tolerance” for timing luck. This is not a one-size-fits-all answer, and investors must find their own balance. More tranches decreases uncertainty, but raises the “hassle factor” because investors have to trade more often.

Sample results follow for the highly sensitive Bold Asset Allocation we showed previously. Note how, as the number of strategies in the Model Portfolio increases, or as an investor’s tolerance for timing luck increases, the number of tranches required falls:

What would be the practical impact of these estimated tranches?

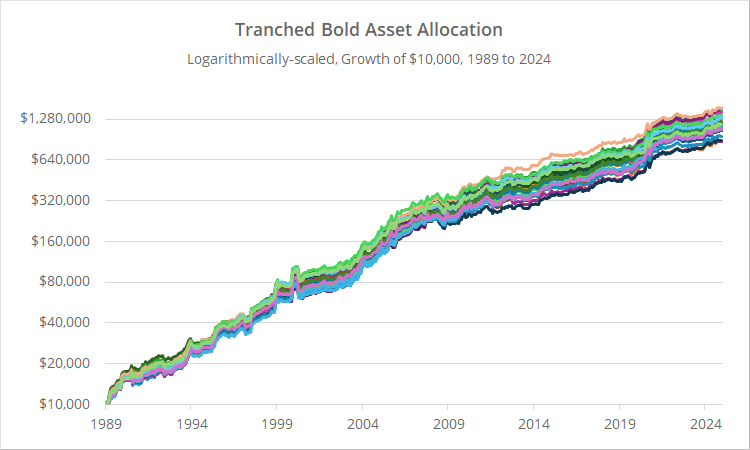

Assume Bold Asset Allocation is the only strategy in our Model Portfolio and we have a “low tolerance to timing luck”. The suggested number of tranches is 8. Below we’ve shown 30 sample portfolios, each with 8 tranches of BAA. The 8 trading days have been randomly selected.

This range of outcomes is less disperse and more predictable than our previous tranche-less test.

The average annual return among our tranched portfolios was 14.2% versus 13.9% for our tranche-less portfolios. That small increase in return was due to a bit of a “rebalancing effect” due to mean-reversion in tranche performance. If that didn’t make sense, don’t worry, the effect is small.

The more important takeaway is the drastic reduction in dispersion among portfolio results. The standard deviation of possible annualized returns fell by almost two-thirds.

Could an investor earn a higher return trading a tranch-less portfolio (i.e. by going all in on a single trading day)? Absolutely. But they could also earn a much lower return, and that’s the point. By tranching the portfolio, we reduce the range of possible outcomes. This is simply another form of diversification.

Methodology, assumptions and limitations:

We’re not going to dive into the math behind how we created these results. For those interested, click to learn more.

In short, we create 1000’s of random Model Portfolios of various sizes and determine how many tranches of this strategy would be required so that portfolio timing luck remained below the investor’s tolerance.

Our use of randomized portfolios allows us to provide a solution to a complex question, but it also requires us to make some simplifying assumptions (detailed here).

The two biggest gotchas to be aware of are:

-

We’ve assumed that all strategies in the portfolio were equally weighted. For example, in a portfolio with 5 strategies, each strategy was allocated 20% of the portfolio. If one of those strategies had 2 tranches, each of those tranches was allocated 10% of the portfolio.If the strategy in question had a larger allocation in the portfolio, the number of tranches required could increase, and vice-versa.

-

We’ve assumed that the other strategies in the portfolio all exhibited above average levels of timing luck (as measured by the “Trading Day Dispersion” statistic in the members report).If the other strategies in the portfolio exhibited very low trading day dispersion, or no dispersion (i.e. daily strategies and B&H assets), the number of tranches required for the strategy in question could decrease.

The main resistance to tranching:

Obviously, tranching increases the “hassle factor”, because it means more trading throughout the month. If an investor valued the simplicity of the once per month trade, then they should do that.

But even if an investor wanted to trade more than once per month, they will often find that adding additional tranches to their Model Portfolios hurts past performance.

That’s because, generally speaking, trading at month-end has outperformed all other possible trading days. We have a report in the members area dedicated to showing just that: The Best Day of the Month to Trade.

We’ve talked quite a bit about the reasons that month-end outperformance might have existed in the past. Despite that fact, we offer 3 reasons to still consider tranching:

- Markets are perpetually evolving. It’s a risk to assume that month-end will always be the best day to trade.

- Even if we knew with certainty that over the long-term month-end would continue to outperform, in the short-term month-end may underperform badly (as the “Best Day” report also shows). Tranching can help to smooth out these periods of underperformance.

- Waiting an entire month to trade is psychologically difficult for more hyperactive investors. Adding a tranche or two intramonth can help the investor feel more responsive to the current market, while still maintaining the integrity of the original strategy.

Our intent is to inform, not to persuade::

This is a nuanced discussion, and like everything we do, our intent is to inform, not to persuade.

Don’t want the hassle of trading more than once per month? No problem. Over the very long term, your performance will probably be similar to a tranched approach.

Willing to accept the risk that month-end remains the best time (or at least a good time) to trade in the future? Great. Month-end has worked best historically, and we can’t say that any other day of the month is better.

On principle, we don’t tell investors what to do. We give you the tools to make informed decisions about your own portfolio. For investors who want to take extra steps to achieve further diversification, we provide this estimate of required tranches. And for investors who don’t, the “default” approach – going “all in” at month-end – is still a reasonable solution.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free membership. Put the industry’s best Tactical Asset Allocation strategies to the test, combine them into your own custom portfolio, and follow them in real-time. Learn more about what we do.