In this post we discuss portfolio “tranching” (i.e. dividing a portfolio into overlapping slices of the same underlying strategy) to minimize “timing luck”. This is an under discussed but important topic in tactical asset allocation. For more smart thoughts on portfolio tranching, see this excellent piece from Newfound Research [dead link]. For our test case, we’ll use a TAA strategy particularly susceptible to timing luck, and show how portfolio tranching leads to more predictable performance.

Sign up today to create your own custom tranched portfolio based on the TAA strategies that we track. View the historical performance of your portfolio, and then track your portfolio in near real-time.

Background

Most tactical asset allocation (TAA) research assumes that trades are placed at the close on the last trading day of each month. That’s because: (a) monthly asset class data is often available much further into history than daily data, allowing for longer backtests, and (b) TAA is by its nature designed to ignore day-to-day noise, so trading too frequently is often counterproductive.

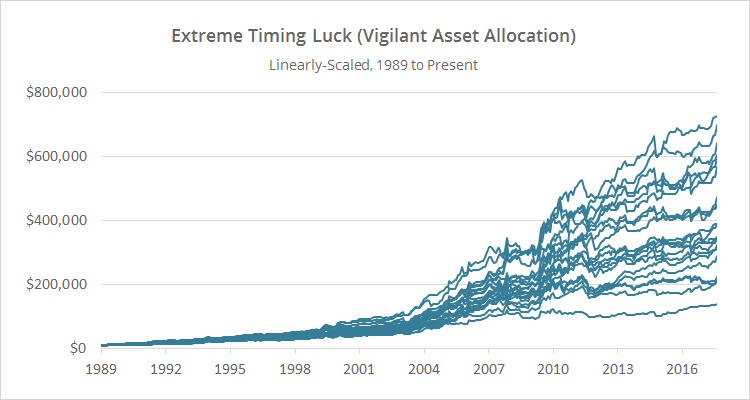

Trading on other days of the month can lead to very different results. To illustrate, below we show the results of trading one such monthly trading strategy, Keller & Keuning’s Vigilant Asset Allocation (VAA), on days other than just month-end. Results include transaction costs (read more about backtest assumptions).

Linearly-scaled. Click for logarithmically-scaled results.

You can find more on the math behind this test here, but for now, know that we always maintain the spirit of the original strategy. If trading mid-month for example, we use previous mid-month prices to perform strategy calculations. We are NOT simply delaying the day of execution.

Annualized returns in our test ranged from a low of 9.6% to a high of 16.2%, and Sharpe Ratios from 0.56 to 1.22. All trading days outperformed the 60/40 benchmark, but the range of possible results investors would have experienced varied wildly.

What accounts for this difference in performance between trading days?

To a large degree, simply good ol’ fashion luck (good or bad) (*). That’s especially true when dealing with a strategy like VAA that takes a 100% position in a single asset based on a relatively “fast” indicator. One day will often make the difference between holding a very risky asset like emerging equities or a risk averse one like US Treasuries.

How do we confidently trade a strategy so prone to timing luck?

It would be irresponsible to simply close one’s eyes, pick a single trading day each month and dive headlong into the unknown. The range of potential outcomes is simply too wide. One simple solution to help minimize timing luck is through portfolio tranching.

Portfolio Tranching

By portfolio tranching we mean dividing the portfolio into overlapping slices, each trading the same underlying monthly (or weekly, quarterly, etc.) strategy on different trading days.

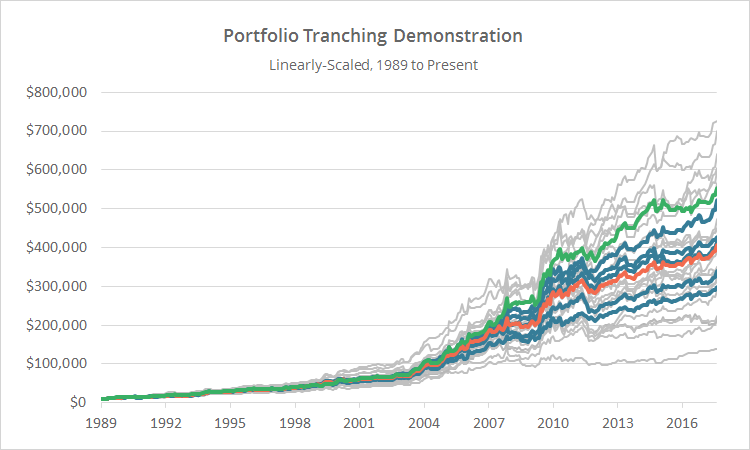

In the test that follows, we’ve tranched the monthly trading strategy shown above, Vigilant Asset Allocation, multiple ways. Results include transaction costs.

- Orange Line: Divide the portfolio evenly across each trading day of the month. In this scenario there would potentially be a small change to the portfolio every day.

- Blue Lines: Divide the portfolio into four equal slices, each trading on (roughly) one week of the month. As discussed here, we normalize each month to 21 trading days (the average number of trading days in a month). The five blue lines shown trade on days: (1, 7, 12, 17), (2, 8, 13, 18), etc.

- Green Line: Divide the portfolio evenly across the five days before and after month-end (days 19-21 and 1-2). This is based on the (debatable) idea that there is an advantage to trading around the turn of the month (see end notes).

Linearly-scaled. Click for logarithmically-scaled results.

As one would expect, returns for the tranched portfolios are more or less in the middle of the range of possibilities. That makes sense. Portfolio tranching is never going to produce the top performer, but it’s also not going to produce the worse.

But that really misses the point. The top performing trading days historically could very well be the worst performing in the future (and vice-versa). To a large degree, it’s impossible to know which will outperform out of sample. That’s “timing luck”. The point of portfolio tranching is to minimize that luck and achieve a more predictable return stream. Investors can be confident that the tranched portfolios shown above are a more accurate representation of the strategy’s performance than any of the single trading days.

There is a secondary advantage of portfolio tranching: reducing volatility. Tranching reduces the stark position changes that some strategies are designed to make, forcing a degree of diversification. Recall our previous example of moving from 100% emerging equities to 100% US Treasuries. Tranching would smooth that change out over time.

Our various tranched portfolios beat between 67% and 100% of the individual trading days in terms of lower volatility, and between 57% and 95% in terms of a higher Sharpe Ratio.

While we think the advantages of portfolio tranching outweigh the disadvantages, disadvantages do exist. It increases the number of trades made each month. It guarantees that an investor isn’t going to get lucky and trade on the most advantageous day. And it makes following a strategy more complex. Of course, that’s an advantage of being a member at Allocate Smartly. We do the heavy lifting for you, to make following a tranched portfolio easy.

Portfolio Tranching at Allocate Smartly

Member instructions:

- To view the performance of a strategy on days other than month-end, select any monthly trading strategy in our members area, and click “Trading on Other Days of the Month”. See an example for Vigilant Asset Allocation.

- To tranche a strategy, add the strategy multiple times to one of your custom model portfolios. Each time you add the strategy you’ll need to use a different trading day and allocate at least 1% of the portfolio to it. You can select trading days based on the results of the alternate trading day stats, or take a more unbiased approach like we’ve done in this post. The number of tranches to add is entirely up to you. There is no right or wrong answer. It’s a balance between the degree to which you aim to minimize timing luck, versus how often you’d like the portfolio to trade.

We invite you to become a member for less than $1 a day or take our platform for a test drive with a free limited membership. Track the industry’s best tactical asset allocation strategies in near real-time, and combine them into custom portfolios. Have questions? Learn more about what we do, check out our FAQs or contact us.

There is a follow on observation to this one, a tendency for trading on days near the beginning and end of the month to outperform trading on other days. That topic is beyond the scope of this post, but we’ve written previously on the subject over at Alpha Architect and on our own blog.