Four recent asset allocation articles (tactical or otherwise) that you might have missed:

1. Bond ETFs in an Era of Rising Rates (Better Buy & Hold)

This is our first post from our new platform BetterBuyAndHold.com. Bonds face stiff headwinds in the coming years, and many will underperform what investors have grown accustomed to. That’s not prognostication; it’s a mathematical certainty. In this post, we model various future scenarios for the largest class of bond ETFs: US Treasuries.

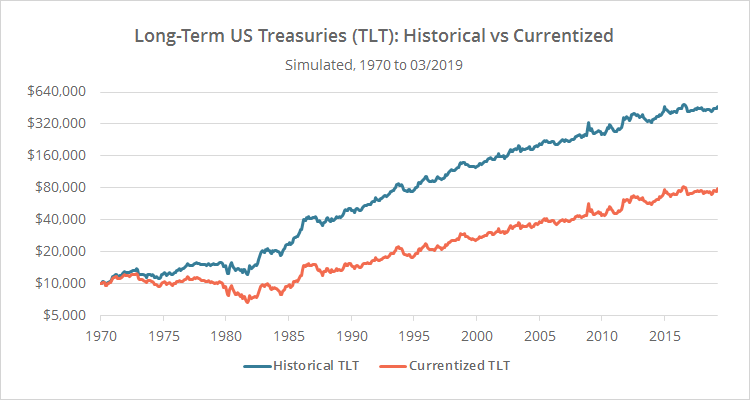

Below is a chart from our post showing the historical performance of long-term US Treasuries (TLT) versus returns that have been “currentized” based on where yields stand today. The difference is stark, with annual returns cut in half, and a deep drawdown of -47% in the early 1980’s.

Bond underperformance is less of a concern for TAA, because most strategies have the ability to rotate out of assets that are underperforming. Rather than trying to implement an aggressive solution like we do on BB&H, on this site we model each strategy’s exposure to rising rates so that investors can take that data point into consideration when selecting strategies.

Buy and hold on the other hand will be, by its nature, severely impacted by underperformance in bonds. It’s a rare thing in this business that we can say that a given asset class will underperform, but in this case, we can. That means that essentially every B&H backtest you come across is inherently a poor reflection of the future.

2. Global Equity Momentum: A Craftsman’s Perspective (ReSolve Asset Mgmt)

ReSolve doesn’t post often, but when they do, it’s always golden.

This post is similar in spirit to a recent piece from Newfound. GEM is a classic momentum-based tactical asset allocation strategy. Due to the nature of GEM, it’s highly susceptible to “specification risk”, or the gap between the long-term results of an investment style (momentum) and the precise strategy we use to implement it (GEM).

This is an uncompensated risk that’s easily managed with an “ensemble” strategy (i.e. diversifying across multiple lookbacks or methods of measuring momentum, AKA “the thing our site was specifically built to do”). You can read our own thoughts on the debate here.

3. Risk Targeting and Dynamic Asset Alloc: Absolute or Relative Momentum? (Rob Carver)

Rob breaks down characteristics of “absolute” vs “relative” momentum. Most of the strategies on our site employ one or both. The key takeaway: “Relative momentum gives a higher geometric mean than absolute momentum, except for investors with low tolerance to risk. Therefore for most investors it’s preferable.”

We agree with the spirit of Rob’s conclusion (though we think most investors may be less risk tolerant than he gives them credit for). A few points we’d add:

- Relative momentum tends to be less tax efficient because it often switches to positions that are only marginally better, as opposed to the more binary “good or bad” call by absolute momentum. Read more.

- It would be interesting to see these results with a multi-lookback (ensemble) model to draw a more general conclusion beyond just this 12-month lookback. See ReSolve’s post above or Newfound’s Fragility Case Study.

- And of course, the sweet spot may be a dual momentum approach that employs absolute momentum to prevent significant portfolio losses (for risk averse investors), coupled with relative momentum to maximize returns when invested (for risk tolerant investors). This approach is shared by a number of strategies that we track.

4. The Speed Limit of Trend (Newfound Research)

In the early days of tactical asset allocation, lookbacks for popular strategies tended to be long-term oriented – think Meb Faber’s GTAA (10-months) or Gary Antonacci’s Dual Momentum (12-months). We’ve added a number of models from recent years that are focused on the shorter-term (at least by TAA’s standards) in the 1-3 month range.

Newfound’s post looks at how long versus short-term trend-following lookbacks perform during drawdowns of various lengths, depths and volatility levels. The primary function of trend-following (which is a core component of TAA) is to manage losses (as opposed to generating outsized returns) so it makes sense to look at the issue in terms of drawdown management.

Where do we fall on the superiority of long versus short-term lookbacks for TAA? Like Newfound, we don’t. We embrace an ensemble approach of mixing multiple effective models.

Other recent links that you might have missed:

- Taxes and Trend Equity (Newfound Research) – Members: see your Tax Analysis report where we model the tax efficiency of all of the strategies that we track. Note the wide disparity in results. Also see our previous work on the characteristics of tax efficient TAA strategies.

- Analyzing Bond Performance in Stock Corrections (Movement Capital)

- Inverted Yield Curve: Danger or Noise? (Two Centuries Investments)

- The 50/50 SPY Strategy (Alvarez Quant Trading)

- Pitfalls When Assessing Market-Timing Strategies (Alpha Architect)

- Investment Strategy in an Uncertain World (Alpha Architect)

- Time Dilation (Newfound Research)

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and then track them in near real-time. Have questions? Learn more about what we do, check out our FAQs or contact us.