This is a test of concepts from the paper Cross-Asset Signals and Time Series Momentum.

Standard “time series” momentum is a well-documented feature of financial markets. Assets going up tend to continue going up. In this paper, the authors show that stocks and treasuries can also be used to time each other. This is “cross-asset” momentum. Treasury momentum is a positive predictor of stock returns, while stock momentum is a negative predictor of treasury returns.

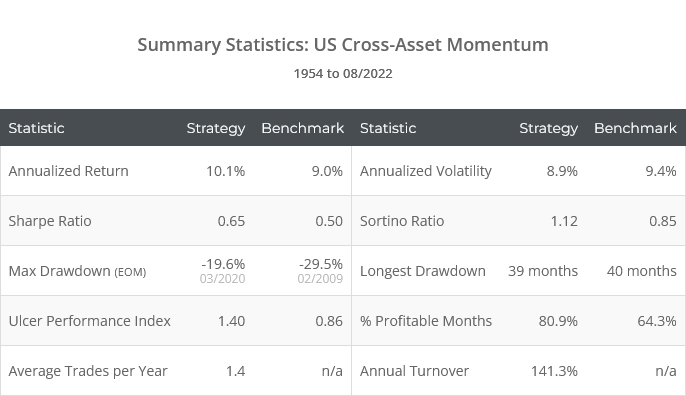

Backtested results from 1954 follow. Results are net of transaction costs – see backtest assumptions. Learn about what we do and follow 60+ asset allocation strategies like this one in near real-time.

Logarithmically-scaled. Click for linearly-scaled chart.

Obviously, these results are not as dramatic as many we cover, but the strategy would have beat a simple buy & hold benchmark while reducing the worst drawdowns. More importantly, it has exhibited low correlation to other strategies we track, potentially making it useful as a diversifier.

Strategy rules tested:

We’ve tested a simplified version of the concepts presented in the source paper in order to fit the standardized approach we take on this site. The authors tested trading both long and short, across many individual international markets, possibly employing leverage (read why we don’t model trading short or using leverage). Here we’ve tested a long-only unlevered US strategy.

Near the close on the last trading day of each month…

- Measure the 12-month return of both the S&P 500 (represented by SPY) and intermediate-term US Treasuries (IEF), in excess of 3-month US Treasury Bills (BIL).

- If the excess return on both stocks and treasuries is positive, go long SPY.

- If the excess return on stocks is negative and treasuries is positive, go long IEF.

-

If neither condition is true, go to cash.Note: the conditions above are mutually exclusive and will never be true at the same time.

- All orders executed at the close. Hold positions until the close of the following month.

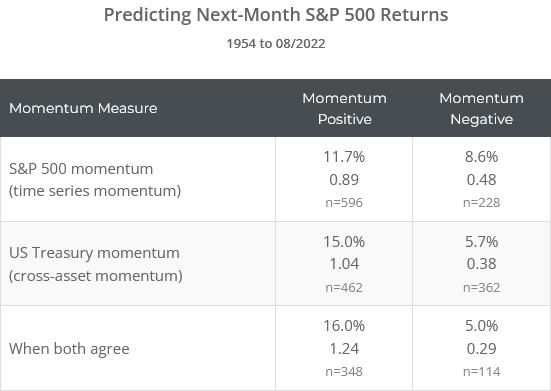

Predicting stock market returns:

As we know, recent stock returns have been a positive predictor of future stock returns. This is standard “time series momentum”. Assets going up tend to continue going up.

The authors show that treasuries have also been a positive predictor of future stock returns. This is “cross-asset momentum”. Treasuries performing well in the recent past has been a bullish indicator for stocks in the near future.

Below we’ve shown S&P 500 returns (dividend-adjusted) based on both time series and cross-asset momentum (as defined in the strategy rules), and when both flavors of momentum agree.

The 3 stats shown are: (1) annualized S&P 500 return in the months when that condition is true, (2) a return vs risk measure calculated as annualized return divided by annualized volatility, and (3) the number of months that met that condition.

Two observations:

- Note how cross-asset momentum has actually been more effective than time series momentum in this particular test, and how it’s been particularly predictive when both flavors of momentum agree. Note too however how few months both flavors agree.

-

We also tested these results with a “zero-coupon treasury” (not shown for brevity). We wanted to ensure that the tailwind provided by the coupon, which was much higher in the past than it is now, wasn’t confusing the analysis. In other words, this zero-coupon treasury only measured the impact of changes in interest rates when measuring momentum.The results were substantially similar. That should give investors some confidence that this observation is just as relevant to today’s era of low rates as it was in the distant past.

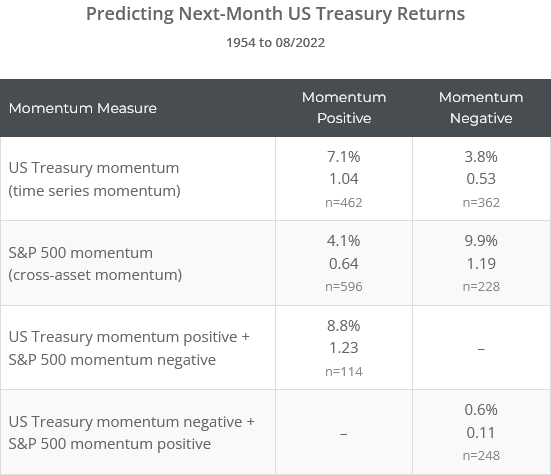

Predicting US Treasury returns:

As with stocks, past treasury returns are a positive predictor of future treasury returns. But unlike stocks, there is a negative cross-asset relationship. Stocks performing well in the recent past has been a bearish indicator for treasuries in the near future.

Our earlier observations apply here as well:

- Combining both momentum measures has been particularly effective, but both measures agree in relatively few months.

- These results are substantially the same when using a zero-coupon treasury to measure treasury momentum.

We’ve tread this ground before:

These results shouldn’t be surprising to long time visitors. Multiple strategies we track use government bonds to predict future stock returns:

- Vigilant Asset Allocation (blog, members: VAA-Aggressive, VAA-Balanced)

- Quint Switching Filtered (blog, members: QSF)

- Bold Asset Allocation (blog, members: BAA-Aggressive, BAA-Balanced)

- Defensive Asset Allocation (members: DAA)

This paper predates all of those strategies, but the paper is also relatively obscure, and I assume the strategy authors made the same discovery independently. In any case, it’s helpful to have an entire study dedicated just to this one narrow observation.

Our take: A good idea in need of a better implementation:

This cross-asset momentum observation has been broadly effective for a very long time, and we think as a concept it’s a useful addition to the tactical trader’s toolbox. Having said that, the specific implementation described here could probably be improved on.

Only about half of months meet the criteria to take a long position in one of the two assets. That means that this strategy would spend half of all months in cash. Given the general upward bias of financial markets, that’s probably too much time spent on the sidelines.

We’ve still opted to track this strategy in our members area because it has exhibited very low correlation to most other strategies we track and may provide opportunities for strategy diversification.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and follow them in real-time. Learn more about what we do.