In our previous post, we touched on FX rates and their impact on international ETFs like EFA or EEM. In short, because international ETFs trading in the US are denominated in USD, most are affected not only by changes in underlying assets, but also by changes in the exchange rate between USD and local currencies (1). This FX risk can have a huge impact on performance.

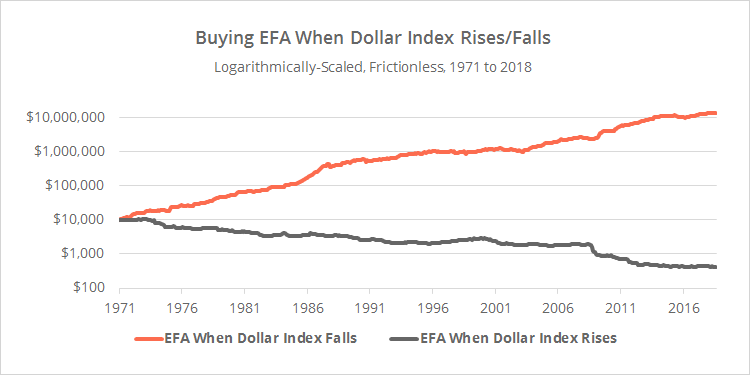

That came as a surprise to some readers, so we wanted to expound a bit on the subject. But first, a simple illustration of how significant an effect this is. In the graph below, I’ve assumed two hypothetical traders held the ETF EFA (the largest of the international ETFs), just during months when the US dollar index either fell (orange) or rose (grey) since 1971.

The results are pretty stark. Even though there are obviously unrelated changes in the underlying assets in those countries in any given month, the FX effect is so significant that over the long-term, it’s all you see. You could create a similar chart with most other international ETFs (1).

Of course, these results would require a trader to have perfect foreknowledge of the US dollar index, so they’re not useful for actual trading, but they do demonstrate the importance of understanding a strategy’s exposure to FX risk.

The knife cuts both ways…sort of:

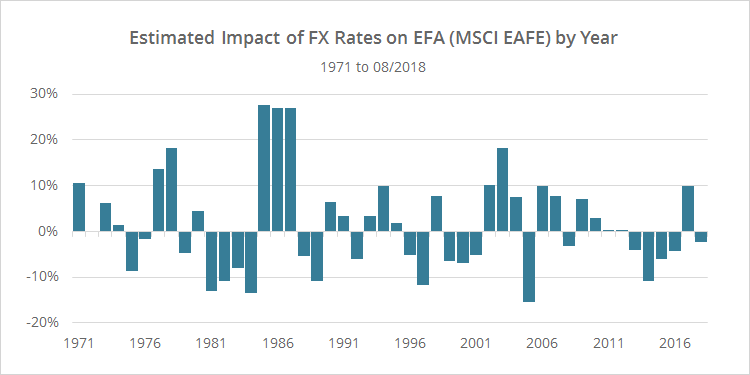

FX risk isn’t always a bad thing. When USD is falling, it generates a tailwind for these ETFs. To illustrate, the graph below shows the impact of FX rates on the MSCI EAFE index (which EFA tracks) every year since 1971. Positive values indicate USD fell over the course of the year and boosted the index, and vice-versa.

This is different than say exposure to rising interest rates (for example, via Treasury ETFs like TLT). At this moment in history, interest rates are limited in how far they can fall, but they have a lot of opportunity to rise. Because of the fact that we’re rising from a low base (unlike periods of rising rates in recent decades), these ETFs are mathematically limited in their upside (read more)

Significant exposure to rising interest rates, without an active tactical approach to manage that risk, is probably inherently bad. Exposure to FX risk is not necessarily good or bad. There will be long stretches of time when it provides a boost to international assets.

Here’s the rub though: because USD is generally viewed as the world’s reserve currency, USD tends to rise/fall against many other currencies simultaneously. That means that you lose some of the diversification that you thought you earned by carefully selecting geographically disparate assets. USD risk may be good or bad for returns, but it’s almost always bad for diversification.

Measuring FX impact:

There are three ways to suss out the impact of FX rates from actual changes in the underlying assets:

- Some international ETFs also come in a currency-hedged flavor. For example, there is a hedged version of EFA: HEFA. By comparing the two, we can get an idea of the impact of FX.

- International ETFs usually track an index, and index providers often produce a local currency version of those indices. This is useful if one needs data much further back into history. Note however, this data is often not freely available, or can be cumbersome to maintain.

- We can use some simple statistical techniques to try to estimate the USD impact. The brains at Alpha Scientist shared one such approach (2).

So what do we do about FX risk? Good news for TAA investors.

So we know that FX rates have a significant impact on the performance of most international ETFs trading in the US, and we’ve discussed three approaches to modelling that impact. But what do we do about it? Should we avoid international ETFs? We would give a resounding NO! International ETFs play an important part in building a diversified portfolio.

There’s good news for TAA investors. If you’re trading the type of momentum/trend-following strategies that dominate TAA and this site, then the solution is, to a large degree, already built into the cake. USD strength leads to international ETF weakness, which leads to these types of active strategies paring down exposure (and vice-versa).

We’re seeing that as we speak on our site. USD has been strong this year. International ETFs have suffered (badly), even though their underlying assets have been fair to middling. As a result, nearly all of the strategies that we track have zero exposure to international ETFs right now. The momentum/trend-following component of these strategies has responded correctly to that USD strength.

If I were taking a less tactical approach though, with a lot of fixed international ETF exposure, I would be more concerned. As previously discussed, it’s difficult to diversify away this FX risk. Currency-hedged ETFs (like HEFA) are an option. There are also DIY currency-hedging techniques, but they add more cost and complexity to a portfolio than most retail investors will accept. Alternatively, you could do what most investors do and simply eat this FX risk as the price of diversification.

We think that it’s important that investors understand these risks. We’ll be adding a new report to our members area later this month modelling these types of less-commonly considered risks for all of the strategies that we track, including: exposure to FX risk, exposure to rising interest rates, exposure to “timing luck”, etc. Follow our blog to stay informed about this new member feature.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and then track them in near real-time. Have questions? Learn more about what we do, check out our FAQs or contact us.

End notes:

(1) Not all international ETFs suffer from currency risk. The exceptions are (a) currency-hedged ETF (like HEFA), and less commonly, (b) ETFs that hold foreign assets already denominated in USD.

(2) Note that this back of the envelope approach will drift over time. First, the USD index is an imperfect representation of any particular ETF’s FX risk. It’s dominated by the Euro, and will be particularly inaccurate for non-Euro markets (ex. Japan). Using specific currency pairs (ex. USD/JPY) may be more useful here. Second, this approach doesn’t account for legitimate changes in asset valuation due to changes in FX rates.