We replicate and track Tactical Asset Allocation strategies by representing each asset class with the largest, most liquid ETF available, regardless of performance. Read why. Over the years, the most suitable ETF to represent some asset classes has changed.

Early next year we are planning to switch to these more suitable ETFs for 8 asset classes:

Important: As we hope we’ve always made clear, these are not necessarily the best ETFs for you. The best ETF for you is specific to your unique financial situation. These are simply the ETF we use to represent each asset class. Find ETFs that provide similar results using the ETF Alternatives Table.

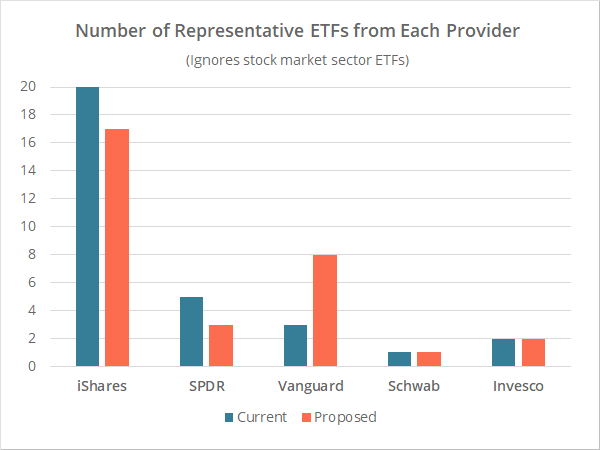

Here’s how the overall number of representative ETFs from each ETF provider will change (we’re ignoring individual stock market sectors, which are all from SPDR). iShares will remain the most common, but Vanguard will become a larger contributor.

Members, your feedback is welcome:

We know that this change will cause some inconvenience for members. Members are used to seeing certain tickers as shorthand for each asset class. Fortunately, most of these, with the exception of EFA and EEM, are less commonly traded on the platform.

We welcome your feedback on these proposed changes.

Close, but not quite different enough:

Because we know members will ask…

There are asset classes where a larger, more liquid choice exists, but the difference isn’t big enough to justify a change. The best example is switching US Corporate Bonds from LQD to VCIT.

We want to give these horse races more time to play out. We’ll revisit them in a year.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free membership. Put the industry’s best Tactical Asset Allocation strategies to the test, combine them into your own custom portfolio, and follow them in real-time. Learn more about what we do.