We’re in a unique position to analyze the behavior of Tactical Asset Allocation investors. Our platform helps members analyze 40+ published TAA strategies from many angles, including: historical performance, tax efficiency, exposure to rising interest rates, etc. Members can combine those strategies together into what we call “custom model portfolios”, which they can follow in near real-time.

In this post, we look at how members are using our site. We think it says a lot about what TAA investors ultimately want when they have choice and technical capability at their disposal. Rest assured that these are aggregate numbers, covering thousands of model portfolios, so it’s impossible to suss out any single user’s behavior.

Specifically we want to look at two questions: (1) What TAA strategies are members choosing, and why? And (2) how important is diversifying strategies?

What TAA strategies are investors choosing, and why?

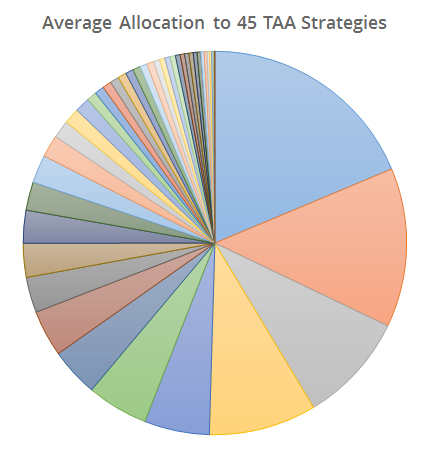

The graph below shows members’ average allocation to each of the 45 strategies that we track. We’ve blanked out the strategy names so as not to unduly influence other members’ decisions, but we think the key takeaway is pretty clear.

The key takeaway: When TAA investors are given the technical ability to analyze many strategies on a level playing field, they tend to collectively gravitate towards just a handful of the “best strategies”.

The top 4 strategies account for 50% of member allocation. The top 10 account for 75%. The last 25% is split between the remaining 35 strategies.

I put “best strategies” in quotes, because that’s such a hard thing to judge. There are so many approaches to determining the best, and so many concerns that are unique to each individual investor (like tax efficiency). Having said that, looking at the most popular strategies, we can see some pretty clear investor preferences:

First, investors want high risk-adjusted returns, as long as they are accompanied by high returns (and not just low risk). What I mean by that is that, given the choice of a strategy with a Sharpe of 1.1 and annualized returns of 10%, and another with a Sharpe of 1.0 and annualized returns of 15%, investors tend to pick the latter.

There’s logic there: because members are combining multiple strategies together into model portfolios, some of the volatility/risk of those aggressive strategies tends to cancel out. I wonder how strategy selection may change when our current bull market runs out of gas. If I thought that was a possibility in the near future, I might begin shifting my focus towards strategies that have done a good job managing return relative to risk.

Other observations:

- There’s a bit of name recognition involved, with investors tending towards strategies developed by people with a public presence, like popular authors and bloggers (although the number one strategy is from a relatively unknown developer).

- There seems to be a general disregard for tax efficiency, with the most popular strategies generating lots of short-term gains. I suspect that’s a function of our do-it-yourself audience being a bit more of “traders” than average TAA “investors” (i.e. I don’t think it’s because the vast majority of members are trading in tax advantaged accounts).

- We’ve advocated in the past a concept of mixing boring low turnover strategies as the core of a portfolio, with more hyperactive aggressive strategies to provide a little “juice”. Members have definitely not taken that advice. Low turnover strategies are consistently at the bottom of the list. Investors just want the juice. Again, I wonder how that might change when significant volatility finds its way back into the market.

There are strategies that I personally think are ranked either too high or too low, but that’s okay. The point of this site is not to tell investors how to invest. The point is to put the decision making data into investors’ hands, so that they can make decisions that are best for them.

How important is diversifying strategies?

As previously mentioned, our platform allows members to combine multiple TAA strategies together into what we call “custom model portfolios”. This provides a level of not just asset diversification, but “process” diversification, as each strategy will take a different approach to trading.

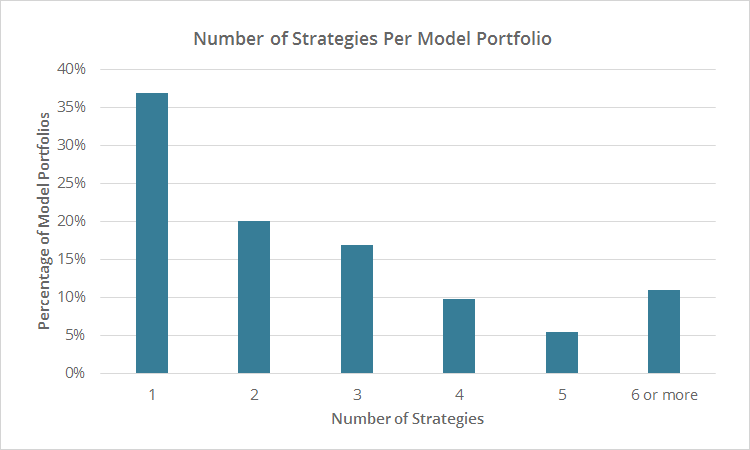

But is that something investors want? The graph below shows the number of strategies that members have included in each of their model portfolios:

These results are encouraging. The majority of members (63%) are incorporating multiple strategies into their model portfolios. Investors do want process diversification. Not too much mind you, but some.

The remaining 37% of model portfolios only include one strategy. Why would a member do that? It’s a function of how our site works. Including a strategy in a model portfolio gives members the ability to receive email notifications, trade on alternate trading days, etc.

The “When” of Diversification (Portfolio Tranching)

We’ve talked in the past about the three types of diversification: what, when and how (an idea inspired by Newfound). So far in this post we’ve talked about the “what” and the “how”, but our site also tackles the “when” with portfolio tranching.

We’ve talked in the past about the three types of diversification: what, when and how (an idea inspired by Newfound). So far in this post we’ve talked about the “what” and the “how”, but our site also tackles the “when” with portfolio tranching.

If you’re new to the concept of tranching, you can read more here. Most TAA strategies trade once per month. Portfolio tranching is simply spreading a once-per-month strategy across multiple days of the month, in order to minimize the “timing luck” (sometimes good and sometimes bad) inherent to trading the entire strategy on just one day.

Members are only using tranching about 10% of the time. We have mixed feelings about that. On one hand, obviously we think it’s inherently good to minimize timing luck, to prevent a bad role of the dice in any given month.

On the other, there are a number of factors that make portfolio tranching less attractive in the real world for retail investors: (1) It increases transaction costs for smaller accounts. (2) It makes execution more difficult, because investors have to execute trades on multiple days of the month, rather than just one. And (3) it’s a new and complicated concept, and new and complicated concepts take time to be embraced by the investment community.

In Summary

For tactical asset allocation investors with choice (access to a lot of strategies) and technical capability (the ability to analyze and follow those strategies intelligently), these results show…

- They gravitate towards a relatively small number of mostly aggressive, high return, high risk-adjusted return, high turnover strategies.

- They tend to combine multiple strategies together to gain the “what” and “how” of diversification.

- They tend not to utilize portfolio tranching, and may be missing out on the “when” of diversification.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and then track them in near real-time. Have questions? Learn more about what we do, check out our FAQs or contact us.