This is a summary of the recent performance of a wide range of excellent Tactical Asset Allocation (TAA) strategies, net of transaction costs. These strategies are sourced from books, academic papers, and other publications. While we don’t (yet) include every published TAA model, these strategies are broadly representative of the TAA space. Learn more about what we do or let AllocateSmartly help you follow these strategies in near real-time.

Commentary:

- Tactical Asset Allocation generally underperformed the benchmark in September.

- TAA entered the month positioned defensively following market weakness in August.

- The market went on to bounce back in September. It was an overwhelmingly positive month for risk assets (ex. SPY +1.9%, EFA +3.1%) and negative month for defensive assets (ex. TLT -3.4%).

- Despite the strong showing from risk assets, TAA still remains cautiously defensive entering October (see data dump below).

TAA did a good job controlling market losses during the pullbacks in late-2018 and twice this year, but in all cases, those losses proved to be short-lived. TAA was positioned too defensively for the subsequent market rebound, and as a result, trails YTD.

To some degree, this is the price of doing business for trend-following/momentum types of strategies. At some point, TAA’s cautious nature is going to save the portfolio from significant loss (ex. 2000-02 and 2007-08), but in the meantime, that risk adversity makes TAA prone to getting stuck on the sidelines when those losses don’t develop. Time will tell whether the current defensive positioning proves to be prescient or if this is another of 2019’s headfakes.

Data dump:

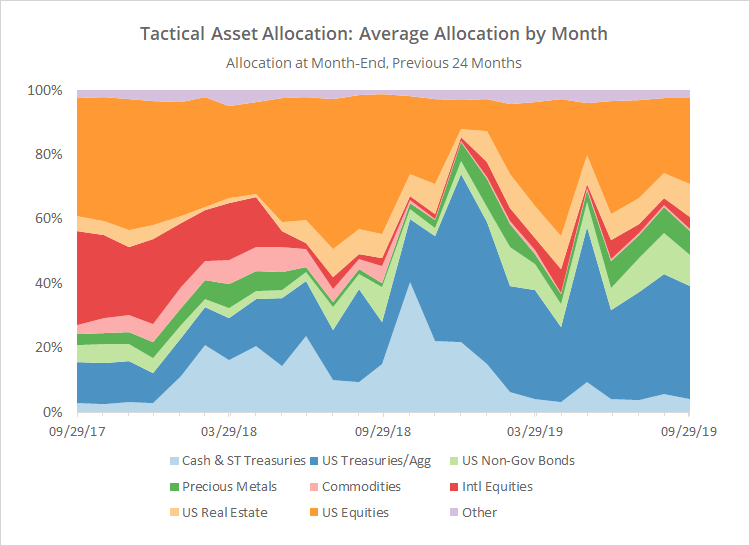

With such a large pool of published strategies to draw on (53 and counting), we’re able to draw some broad conclusions about the state of TAA. The following two charts help to show trends in the asset classes that TAA as a whole is allocating to over time.

The first chart shows the average month-end allocation to categories of assets by all of the strategies that we track. For example, “US Equities” may include everything from the S&P 500 to individual stock market sectors. Defensive assets tend to be at the bottom of the chart, and offensive at the top. The data on the far right of the chart reflects where TAA stood as of the end of the most recent month.

There were no significant shifts in allocation at month-end: a bit out of cash and bonds (7% in total), mostly into US equities and real estate (6% in total).

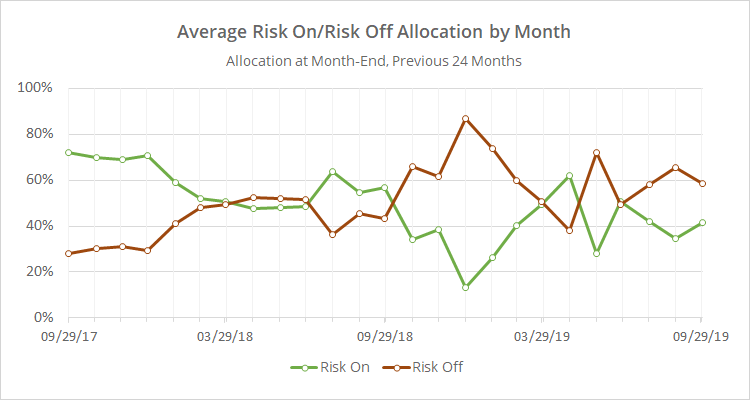

In the second chart below, we’ve combined average TAA allocation into even broader categories: “risk on” (equities, real estate and high yield bonds) versus “risk off” (everything else). We realize that some asset classes don’t fit neatly into these buckets, but it makes for a useful high level view.

TAA remains mostly defensive, but is still far below historical extremes (click for a longer view).

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and then track them in near real-time. Have questions? Learn more about what we do, check out our FAQs or contact us.