This is a summary of the recent performance of a number of excellent tactical asset allocation strategies. These strategies are sourced from books, academic papers, and other publications. While we don’t (yet) include every published TAA model, these strategies are broadly representative of the TAA space. Read more about our backtests or let AllocateSmartly help you follow these strategies in near real-time.

Commentary:

October saw broad losses across the tactical asset allocation landscape.

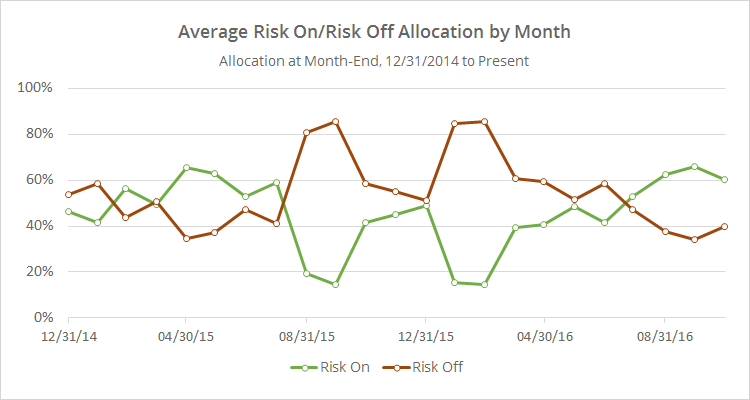

Nearly all significant asset classes were down for the month, notably US real estate (VNQ, -5.7%), US small cap equities (IWM, -4.6%), long-term US Treasuries (TLT, -4.4%) and gold (GLD, -2.9%). This was made worse by the fact that entering in to October, TAA strategies were mostly in risk-on mode, with allocation to defensive assets like Treasuries and cash at multi-year lows.

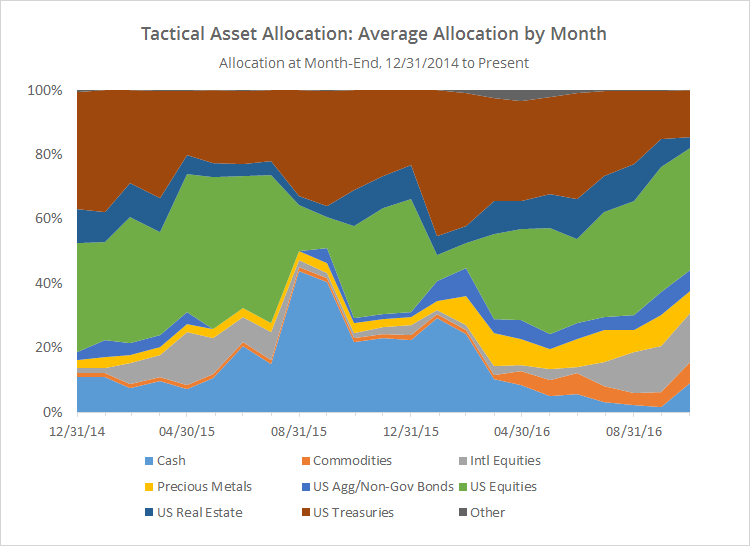

The chart below shows the average allocation to broad categories of assets by the 22 strategies that we track, as of the end of each month since EO’2014. Note how allocation to cash (light blue) has begun to pick up.

Below I’ve combined asset classes into even broader categories: “risk on” (equities, real estate and high yield bonds) versus “risk off” (everything else). I realize that some asset classes don’t fit neatly into these buckets, but it makes for a useful high level view.

As a whole, these TAA strategies are still in risk-on mode. As previously mentioned, while we don’t (yet) track every published tactical asset allocation model, the 22 strategies that we do track are broadly representative of the TAA space, and I think it’s fair to draw some broader conclusions from this data. Tactical asset allocation overall remains bullish on risk, but there is significant exposure to investors here if the market continues to soften in November.