In this post we look at what major asset classes have proven to be the best defensive choice in months when the market has fallen over the last 50+ years. We’ll look at multiple government and corporate bond assets, diversified commodities, gold and the US dollar.

The results? As expected, a mixed bag. Investors who blindly assumed any defensive asset was a sure thing in times of market stress would have been disappointed over the long-term.

Major defensive asset classes when the stock market has fallen:

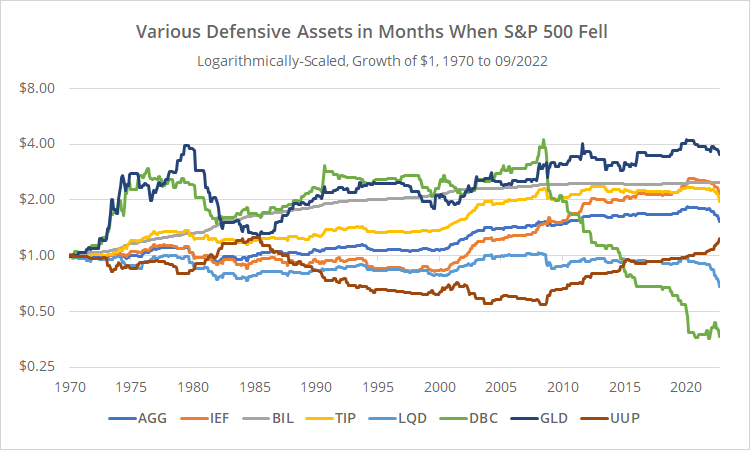

First, we look at how major defensive asset classes performed in all months since 1970 when the S&P 500 was down for the month (1). We’ve used the S&P 500 as our proxy for “the market”, but we would expect these results to largely hold for other major USD denominated risk assets.

This chart is a pile of spaghetti. We’ll break out individual asset classes in a moment.

Logarithmically-scaled. Click for linearly-scaled chart.

Logarithmically-scaled. Click for linearly-scaled chart.

The asset classes shown are:

- AGG: Aggregate US bonds

- IEF: Intermediate-term US Treasuries

- BIL: Short-term US Treasuries (essentially, the risk-free rate)

- TIP: Inflation-protected US Treasuries

- LQD: US corporate bonds

- DBC: Diversified commodities

- GLD: Gold

- UUP: US dollar index

This list isn’t exhaustive. We’ve focused on the largest conventional asset classes (plus UUP for reasons we’ll discuss in a bit), because by definition, this is where most investor wealth is held.

Edit: In hindsight, we should have added intl. bond assets to the mix to present a more balanced picture. We ran the numbers on both intl. treasuries (BWX) and agg. bonds (BNDX). The results were different than the US counterparts in the micro, but in the macro, the same conclusions presented held.

The key takeaway is that only one asset class, gold (GLD), outperformed short-term US Treasuries (BIL) over the entire 50+ year test (and that was only after some big losses along the way). All defensive asset classes were unreliable diversifiers at various points in our test.

Note: This conclusion would be unchanged had we used some more extreme definition of a down month, such as the S&P 500 losing more than X%. We’ve focused on a 1-month timeframe (versus say, days or years) because tactical asset allocation strategies tend to trade monthly.

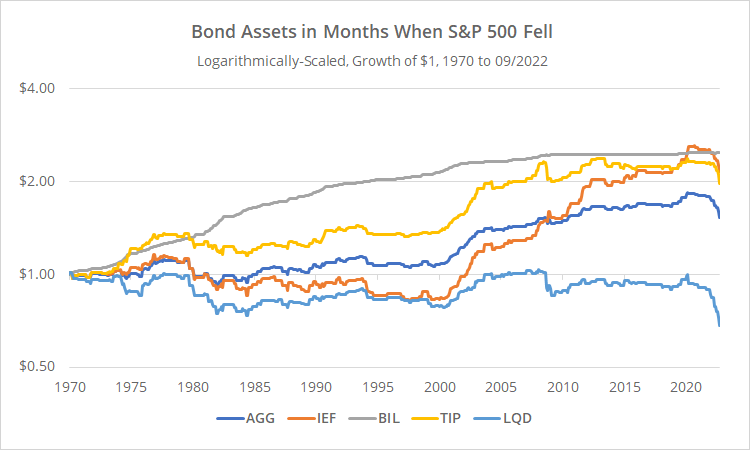

Bonds when the stock market has fallen:

Below we’ve zeroed in on just bond asset class performance in months when the S&P 500 fell.

Key takeaways:

- The performance of longer-duration US Treasuries (AGG, IEF, and TIP) was middling up until roughly the turn of the century. After that point, returns were more consistently positive. That is, until the rate spike this year, when all suffered a sharp downturn.

- This differs from the performance of very short-term US Treasuries (BIL). BIL is less impacted by short-term changes in interest rates or the stock market. BIL returns have fallen over time as coupon yields have also fallen, but would have never experienced a significant drawdown.

- US corporate bonds have been the worst performing bond asset class during falling stock markets. That shouldn’t come as a surprise, as corporate bonds tend to have a strong positive correlation with stock returns.

Note: We used IEF (7-10 year duration) to represent “pure” long-duration US Treasury exposure, but these conclusions would hold had we instead used a shorter (ex. IEI) or longer duration (ex. TLT) alternative.

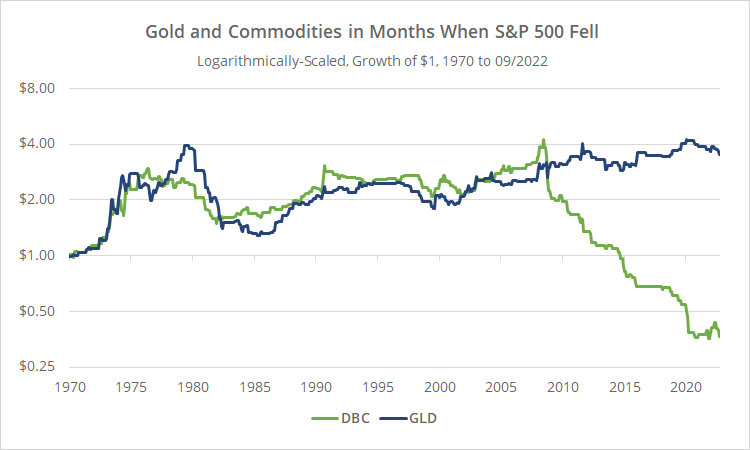

Gold and Commodities when the stock market has fallen:

Below we’ve zeroed in on just gold (GLD) and diversified commodities (DBC) performance in months when the S&P 500 fell.

As previously mentioned, gold is the only major defensive asset class that’s outperformed short-term US Treasuries over the last 50+ years when the market has fallen. Along the way however, gold would have hit some very rough patches, including a drawdown of -67% in the mid-1980’s that would have taken about 34 years to recover from.

Diversified commodities (DBC) would have been a better diversifier until 2008 (2). Since that point, DBC has essentially acted like a risk asset, consistently falling in months when the stock market fell.

In short, both gold and commodities have provided diversification opportunities at various points in history, but both have also come with significant risk that needs to be managed.

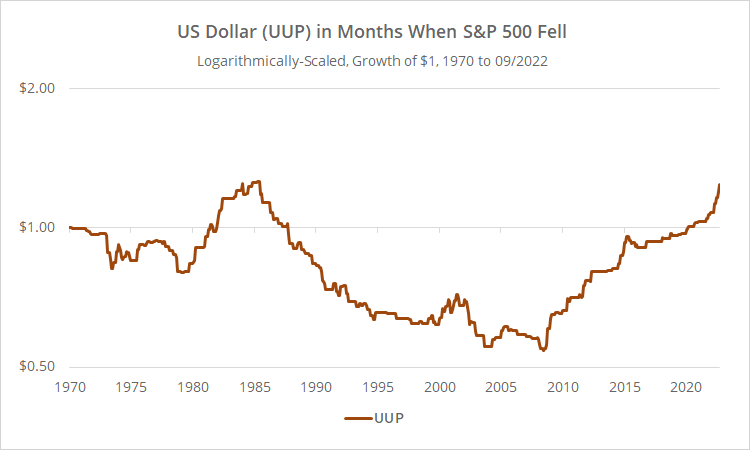

US Dollar when the stock market has fallen:

Below we’ve zeroed in on just the US Dollar Index (UUP) in months when the S&P 500 fell.

The data shown above was actually the inspiration for this post. A reader sent in an analysis from a third-party concluding that the US dollar was their defensive asset of choice, because it has been consistently bullish in months when the stock market fell.

The problem with that analysis is that it was based on just the period of time since the ETF UUP began trading in early 2007. Yes, over that period of time UUP has consistently risen when stocks have fallen. However, our longer analysis shows that to be a relatively recent effect. Over the long-term, results have been mixed.

In short, the US dollar is the most unreliable diversifier of any major defensive asset class included in this analysis.

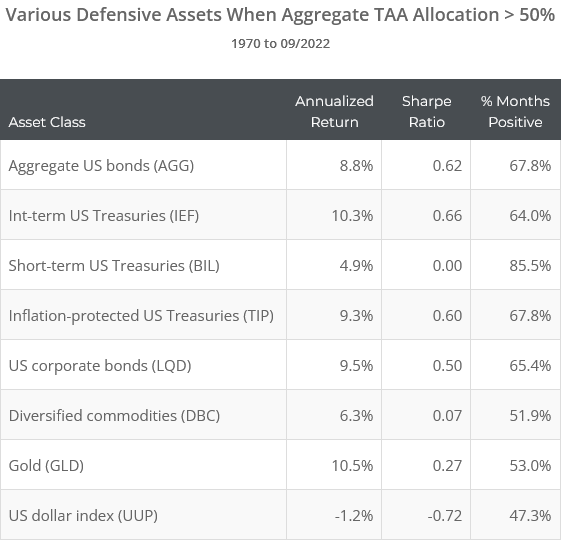

Major defensive asset classes when TAA defensive exposure is high:

Perhaps this all really misses the point though. The results so far assume that we had perfect foresight of those months when the US stock market would fall. That is of course impossible. What we really want to know is how these defensive assets have performed when tactical asset allocation (TAA) strategies would have actually invested in them.

Below we’ve shown the performance of these defensive asset classes in months when the aggregate defensive allocation across all TAA strategies we track exceeded 50% to start the month. Unlike our previous tests in which we assumed perfect foresight, these results actually could be achieved.

We track 70 published TAA strategies, so these results are broadly representative of tactical asset allocation as a whole. Obviously, TAA strategies usually don’t invest in a single defensive asset; they tend to select specific defensive assets based on current market conditions. This is a more generalized analysis asking what if we could only invest in a single asset.

Logarithmically-scaled. Click for linearly-scaled chart.

These results are much more consistently positive than in our previous tests. All asset classes except the US dollar (UUP) have outperformed short-term US Treasuries (BIL) over the entire test.

The US dollar aside, commodities (DBC) have been the least consistent, while longer duration bond assets (AGG, IEF, TIP and LQD) have been the most consistent.

The juxtaposition of these results came as a surprise to us. It says that effectiveness of TAA hasn’t just been in predicting when risk assets would fall, but also, when defensive assets would rise.

A word of warning about using bonds as defensive assets:

As shown above, when TAA has invested heavily in defensive assets, bonds have been a reliable choice for most of the last 50+ years.

As a result, some of the strategies we track have the bad habit of treating long-duration bonds as a “catchall” defensive asset, without considering the current state of those bonds and without a means to rotate out of them when they underperform.

While that approach worked well historically, it’s failed miserably this year, with both risk assets and bonds falling in unison (read more and more).

We attempt to model this potential exposure to rising interest rates for all 70 strategies we track in our Exposure to Rising Interest Rates report. Strategies with low exposure to rising rates have drastically outperformed strategies with high exposure this year.

Conclusions:

The broad conclusion from these results is that no single major asset class is a sure-fire choice to provide defensive exposure when risk assets turn sour.

- Long-duration bonds have worked most of the time when TAA has shifted to risk off, but that hasn’t been the case (and may continue not to be the case) in our new era of rising rates.

- Short-duration bonds are a safer choice, but don’t provide much juice at today’s still low interest rates.

- Gold is generally a good choice but comes with significant risk.

- Commodities have been a terrible choice since 2008.

- The US dollar (the original inspiration for this post) may have been a good choice in some cases in recent history, but that will likely be short-lived.

All defensive asset classes should be managed just like we do with risk assets, whether that be with trend-following, momentum or some other quantitative approach.

Some tactical strategies do a good job of that. Others, less so.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and follow them in real-time. Learn more about what we do.

* * *

Calculation notes:

- Asset class data throughout this post has been adjusted for dividends, but unlike most of the data on this site, we’ve ignored transaction costs and slippage.

- There isn’t a consensus on how to weight diversified commodity indices, and index performance will vary more widely than other asset classes analyzed. We’ve modelled returns for DBC here (which tracks the Invesco commodity index) versus other alternatives like GSG (Goldman Sachs commodity index). Intuitively, we believe that these indices are similar enough that the basic conclusions presented here hold across all major commodity indices.