It always feels a little offensive talking dollars and cents at times like this (*), but we hope that by helping investors to have a concrete strategy, we can at least take this one stress off the table.

We track 60+ Tactical Asset Allocation (TAA) strategies, allowing us to draw some broad conclusions about TAA as a style. So far, TAA has followed the pattern investors have come to expect:

- Initial market losses have been pared down

- Portfolios have been significantly de-risked, with further de-risking expected next month if market losses continue

- Performance over this entire event will depend on whether this is the beginning of a protracted bear market or just a short, sharp pullback

Initial market losses pared down:

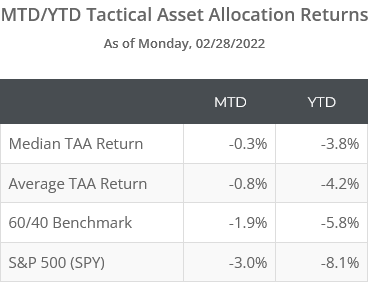

The MTD/YTD return of the 60+ strategies we track as of Monday, 02/28 follow. Results are net of transaction costs (see backtest assumptions):

As we’ve discussed previously, TAA investors should expect some early losses when the market falls so abruptly. By design, there’s a degree of “wait and see” built into tactical strategies.

The right amount of delay is important. If strategies are too slow to respond, too much loss accumulates before they de-risk. If strategies are too quick to respond, they’re prone to whipsaw (i.e. repeatedly being on the wrong side of a vacillating market).

Portfolios have significantly de-risked, with more to come:

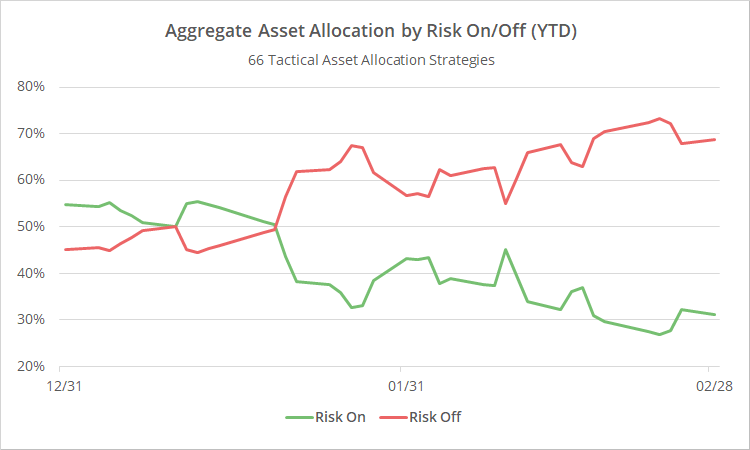

Right now, the average TAA strategy is 69% allocated to defensive assets like bonds and gold.

Below we’ve shown the aggregate allocation this year across all strategies we track, grouped by either risk on assets in green (equities, real estate, etc.) or risk off assets in red (treasuries, gold, etc.)

TAA began de-risking in January. During the worst of past crises, defensive allocations eventually reached about 90%, so there’s still a lot of room left to tighten. Investors should expect a further shift towards defensive assets in the coming month if market losses continue.

Expected performance over this entire event:

Our last post covered precisely this topic. How TAA likely performs in the coming months is pretty straight-forward:

- If this is the start of a protracted market decline, TAA is well positioned to outperform. Bear markets have been TAA’s bread and butter.

- If this is just a short, sharp pullback (like 2018 and 2020) TAA will probably give back the outperformance to date, because it will be positioned too defensively for the sharp recovery.

Of course, at this point we don’t know which type of decline this will eventually become. The same cautiousness that saves the portfolio in the prolonged bear market, causes the portfolio to be positioned too defensively for the short, sharp pullback. Net-net however, tactical has outperformed over the long-term, and we have to accept a little bitter to get the sweet.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and follow them in real-time. Learn more about what we do.

* * *

(*) …but just so our children know we were on the right side of history: We stand with the people of Ukraine and those in Russia who seek a free and peaceful world. To those that are responsible for this madness, the Ukrainian Ambassador to the UN said it best: There is no purgatory for war criminals; they go straight to hell. Slava Ukraini!