Questions about this long-ago strategy from Cliff Smith land in our inbox periodically (here’s another recent take). Smith’s simple strategy trades senior loan (aka leveraged loan) ETFs like BKLN, and has continued to be effective at timing these ETFs in the 10+ years since it was published.

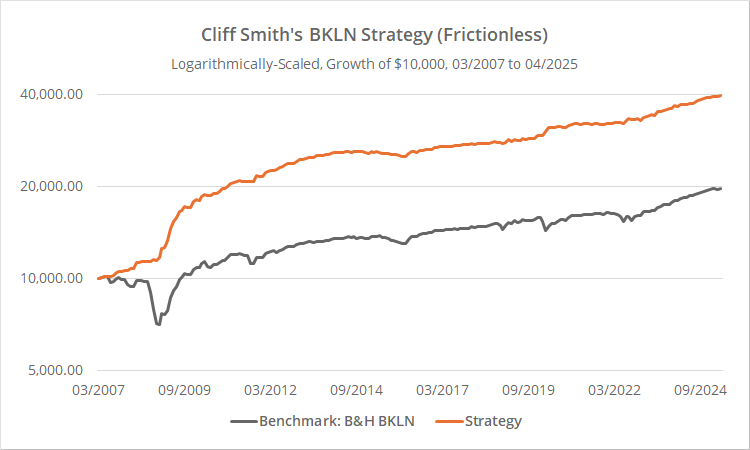

We’ve extended the author’s original test back to 2007 using underlying index data (*). Important: The results below do not account for trading costs (we’ll include costs later in this analysis). Learn about what we do and follow 90+ asset allocation strategies like this one in near real-time.

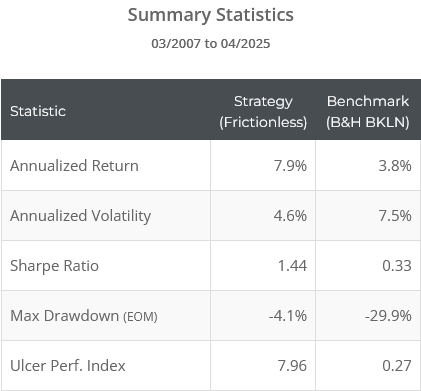

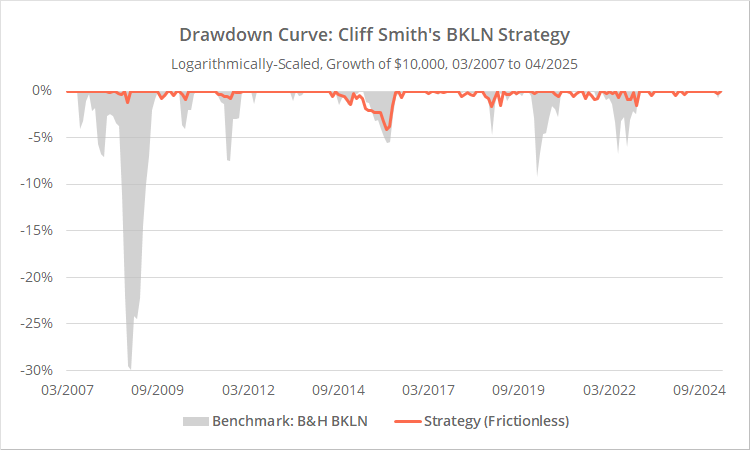

Obviously, the overall results are skewed by the big returns in 2008/09, but the strategy has remained a steady, consistent performer since. Nobody is getting filthy rich by trading senior loan ETFs, but that isn’t the goal. The strength of the strategy has been its extremely low risk (ex. volatility and drawdown) and high return relative to risk (ex. Sharpe and UPI).

Strategy rules tested:

This is a very simple strategy:

At each day’s close, if the 3-day moving average of the ETF BKLN will end the day above the 12-day moving average, go 100% long BKLN at the close, otherwise move to cash.

That’s it.

Because we know readers will ask, this pairing of short MAs hasn’t been particularly effective on most other asset classes we tested, including both risk assets and bond assets. It has been effective (but less so) on related high yield bond ETFs like HYG.

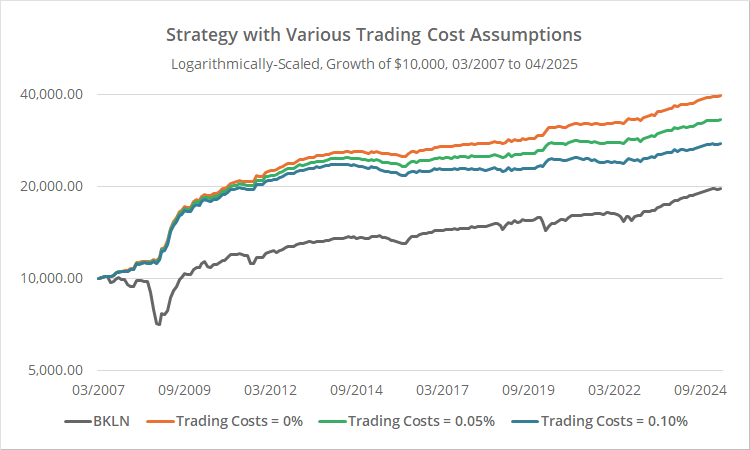

The fly in the ointment: trading costs (transaction fees + slippage)

Two observations:

- BKLN, and other senior loan ETFs like SRLN, FTSL and FLBL, are low volatility investments (most of the time, see 2007-08). They just don’t move that much day to day.

- The use of fast moving averages means that this strategy trades often, at least from the perspective of tactical investors like us who trade just a handful of times per month.

Combining those observations (lots of trades on a slow-moving investment) means that any trading friction is going to take a big bite out of returns.

We make a conservative platform-wide assumption for trading costs of 0.1% per trade (0.2% round-trip). Below we’ve applied our standard assumption to these results in blue, as well as half that assumption (0.05% per trade) in green. Note the significant deterioration in performance.

At our standard 0.1% trading cost assumption, the strategy has been essentially flat for 11 years.

There are ways to reduce trading costs for this strategy:

- You can trade BKLN and other similar senior loan ETFs commission-free at some brokers.

- You could pre-calculate the price at which the 3-day moving average will cross above/below the 12-day MA and either

use a LOC order if available, or simply your own intuition to match or beat the closing price.

If you can sufficiently reduce trading frictions and are looking for a super conservative approach, this strategy might fit the bill. However, based on the conservative trading cost assumption on our platform, the strategy as it’s designed isn’t a good match.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free membership. Put the industry’s best Tactical Asset Allocation strategies to the test, combine them into your own custom portfolio, and follow them in real-time. Learn more about what we do.

* * *

(*) Calculation note: Results prior to inception of ETF in early 2011 based on underlying index data (Bloomberg ticker: SPBDLL) with a contemporary expense ratio (0.65% pa) applied.