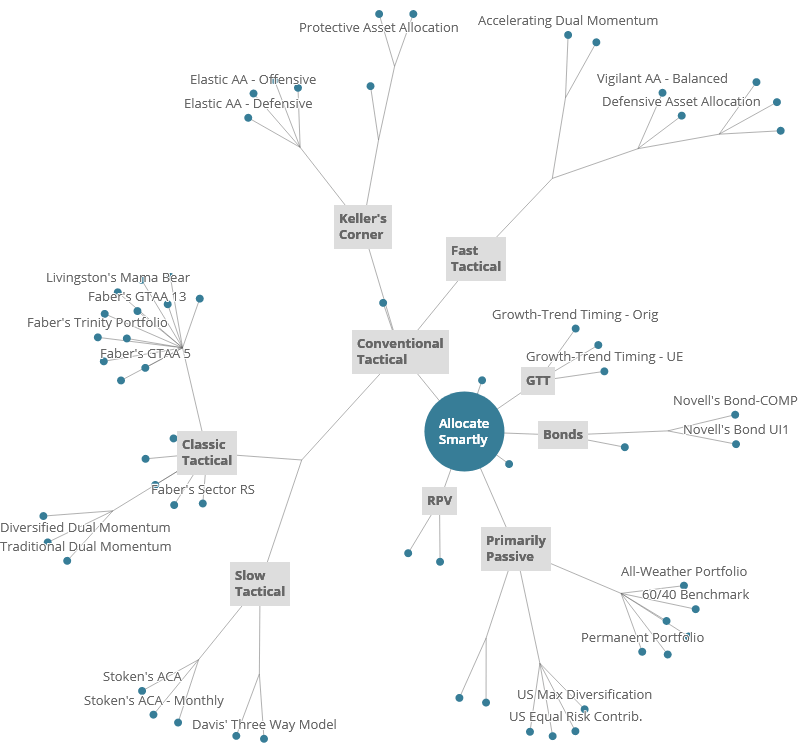

We track a lot of tactical strategies, and it can be difficult to understand how they all fit together in the big picture. The usual correlation matrix (example) is helpful when drilling down on a single strategy, but it’s near impossible to see the forest for the trees among the 1000’s of data points.

In response, we’ve added a new feature that we hope will provide clarity: a Cluster Analysis.

We apply a statistical technique called Hierarchical Clustering to visualize the relationships between strategies by grouping them into clusters, much like branches on a tree. The image below is a simple static version, with some names missing due to space constraints. The actual report in our members area is dynamic and users can hover over data points to see each strategy.

We’ve let the statistical algorithm be our guide in creating these results. Hierarchical Clustering is a form of exploratory data analysis. Strategies in a cluster will tend to behave similarly, strategies on the same branch less so, and strategies on other branches less so still.

It’s important to note that cluster analysis is, by its nature, a simplification. Strategies may have elements of multiple clusters, and the boundaries between clusters are rarely clear-cut. This analysis is only meant to provide a high-level view of the tactical landscape.

We’ve added text labels to each branch to provide some context about the types of strategies that can be found there. They are:

- Conventional Tactical Asset Allocation (TAA):

- Classic Tactical: Includes many of the O.G. strategies that started the popularization of tactical asset allocation from authors like Faber, Alpha Architect, Antonacci, etc. Tend to use long lookbacks, with minimal complexity.

- Slow Tactical: Like classic tactical but these tend to exhibit even lower turnover and be especially tax efficient.

- Keller’s Corner: Many of author Wouter Keller’s strategies share common features and fall somewhere between classic and fast TAA.

- Fast Tactical: In recent years, TAA strategy design has tended towards these strategies that are quicker to respond to market changes, exhibit higher turnover, with more complexity.

- Primarily Passive: These are strategies that are either completely passive (we track five well-known buy & hold strategies) or have a significant passive component. Performance of these strategies tends to be driven by asset risk more than strategy risk (read more).

- There are also smaller branches for unique clusters of strategies that don’t fit elsewhere:

- GTT: Growth-Trend Timing style strategies that blend economic indicators and price analysis. Other strategies do the same, but not in such a concentrated fashion.

- RPV: Risk Premium Value strategies that are based on risk premium valuations.

- Bonds: Strategies that only trade bond asset classes.

- There are a handful of oddball strategies (like “Sell in May”) that live alone.

Members: View your new Cluster Analysis now. As always, your feedback is welcome.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and follow them in near real-time. Not a DIY investor? There’s also a managed solution. Learn more about what we do.