Vigilant Asset Allocation from Dr. Keller and JW Keuning is one of the most popular tactical asset allocation strategies that we track (click for the full list). The authors’ original paper includes multiple variations of the strategy, based on the number of assets held at any given time and how aggressively the strategy moves to defensive assets during periods of market stress.

Up to this point we’ve only tracked the most aggressive variation of the strategy (1). By popular demand, we’ve added a second, much less aggressive variation as well (2), which you can find in the members area as “Vigilant Asset Allocation – Balanced”. Members: go there now.

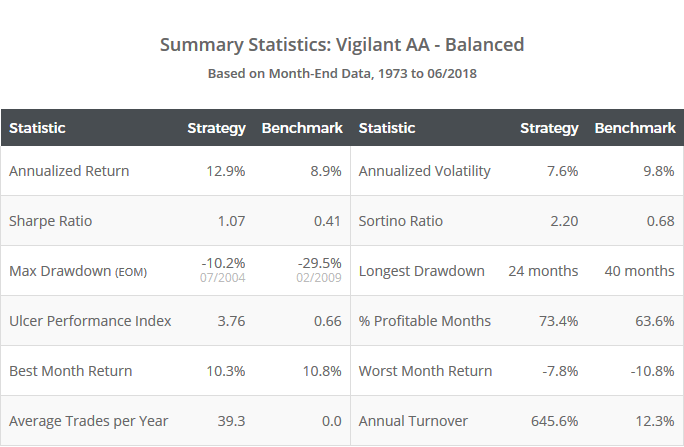

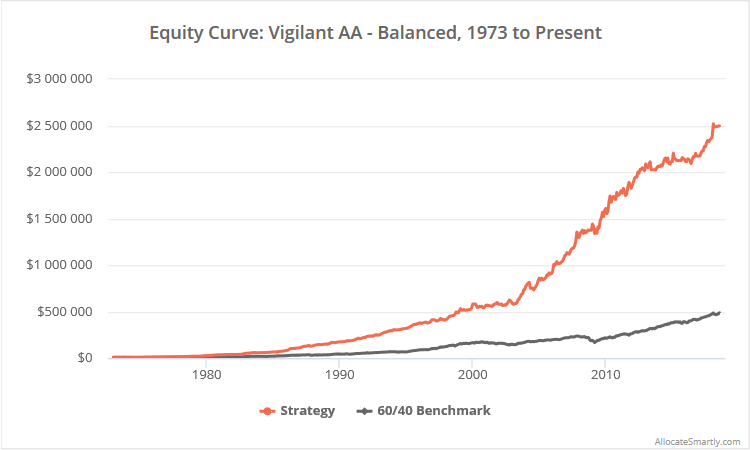

See the source paper and our previous blog post for strategy rules. Results from 1973 to the present, net of transaction costs, follow. Read more about our backtests or let AllocateSmartly help you follow 40+ TAA strategies like this one in near real-time.

Linearly-scaled. Click for logarithmically-scaled chart.

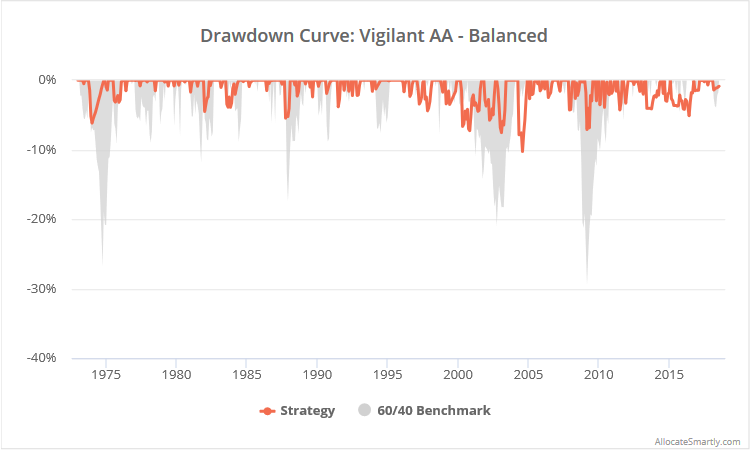

This more balanced version of the strategy is much less concentrated than the original, holding up to five assets at once (versus only one). While the strategy could still at times become very concentrated in risky assets, it’s still more likely to hold at least a portion of the portfolio in defensive assets at any given time. The net effect of that can be seen in significantly reduced volatility and drawdown compared to the aggressive variation.

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and then track them in near real-time. Have questions? Learn more about what we do, check out our FAQs or contact us.

End notes: (1) (2) In the source papers’ parlance, the aggressive variation of the strategy is G=4/T=1/B=1, and the balanced version G=12/T=5/B=4.