We’ve just released version 2.0 of our Portfolio Optimizer, and the nerds in us are pretty excited.

New here? We track tactical asset allocation strategies. Members can combine those strategies together into what we call “Model Portfolios”. The Portfolio Optimizer shows the optimal mix of strategies to trade in your Model Portfolios based on objectives like maximizing the Sharpe Ratio or minimizing volatility.

We’ve added three awesome new features to the Portfolio Optimizer:

- Backtest optimal portfolios

- Clone optimal portfolios

- Build portfolios that avoid strategies with high exposure to rising interest rates

New feature #1: Backtest optimal portfolios:

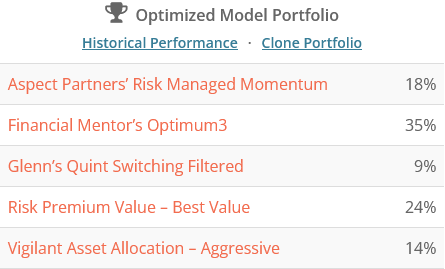

Previously, we simply showed you the optimal portfolio allocation. For example, if you wanted to combine 5 strategies on our site to achieve the maximum historical Sharpe Ratio possible, you would just get a list of allocations like this:

For you to actually see the historical results of that optimal portfolio, you would have to manually replicate it in one of your own Model Portfolios. With almost 400 optimal portfolios available, that could get real tedious real fast.

We’ve now included a “Historical Performance” link on each portfolio (see the blue link in the image above). It will take you directly to the normal lineup of charts and stats you expect to see on all Model Portfolio backtests.

New feature #2: Clone optimal portfolios:

If you find an optimal portfolio that you like and want to use it as a starting point in building your own portfolio, you can now click the “Clone Portfolio” button (see the blue link in the image above).

It will transfer the optimal portfolio allocation to one of your own custom Model Portfolios. Note: be sure to then save, test, or commit the Model Portfolio to retain your changes.

New feature #3: Avoid strategies with high exposure to rising interest rates:

The Portfolio Optimizer has multiple configurable options, like including buy & hold assets or only including tax efficient strategies in the optimizations (click the image to the right for a screenshot).

We’ve added another that we think is especially important in the current market: avoiding strategies with high exposure to rising interest rates.

We make that determination based on the members report of the same name. The report considers both quantitative and qualitative factors to estimate each strategy’s exposure to an extended period of rising interest rates (like we find ourselves in now).

The report has been bang on this year predicting strategies that successfully navigated this difficult and abnormal period of major simultaneous losses in both risk assets and bonds (read more).

We say this option “avoids” such strategies, because we don’t set a hard limit on what it means to have high or low exposure. Instead, we use a sliding scale. The higher the exposure, the less likely it is that a strategy will be included.

The same maximum Sharpe Ratio portfolio shown previously would look as follows. Note the strategies that were dropped, especially Glenn’s QSF and Risk Premium Value (both very high exposure strategies). The 3 replacement strategies are all much better suited for navigating an environment of rising rates.

If you backtest the two portfolios you’ll see that the first one (that doesn’t avoid any strategies) performs a little better than the second historically. That makes sense as it’s doing a “pure” optimization, with no limitations.

But if you’re of the mindset that we’re at the end of 40+ years of falling interest rates and that rate sensitive assets face strong headwinds in the coming years (read more), then the second portfolio is more likely to outperform in the future (the only performance that actually matters).

A word of common sense:

There are all sorts of factors that may be important to an investor when selecting strategies that this tool doesn’t consider. These results are only meant to provide a starting point in your research based on what’s worked in the past.

What’s next:

We plan to circle back in the future for a planned version 3.0 of the Portfolio Optimizer. Our vision for version 3.0 is to allow members to specify the list of strategies to draw from when creating optimal portfolios (rather than choosing from all strategies we track). That’s a big task to perform on the fly as some of these optimizations are quite resource intensive.

We appreciate the valuable feedback we receive daily from members. It leads to new features like this latest upgrade. While we can’t meet every request, when we see something that our community is collectively asking for, it helps us to focus our efforts on what matters most. Thank you!

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and follow them in real-time. Learn more about what we do.