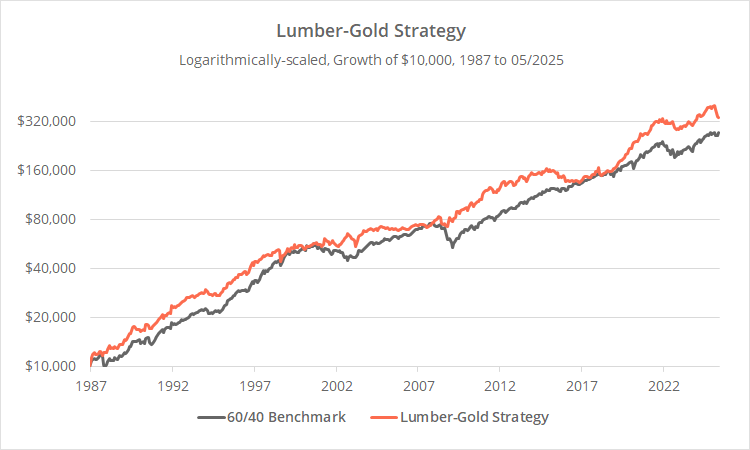

The Lumber-Gold Strategy was first published a decade ago, won the 2015 NAAIM Wagner Award, and continues to be cited today. The strategy trades based on the relative strength of lumber as a leading economic indicator, versus gold. How has the strategy performed since publication?

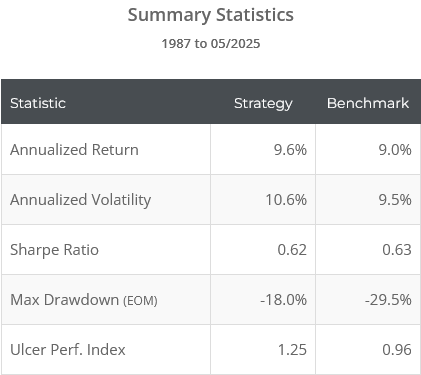

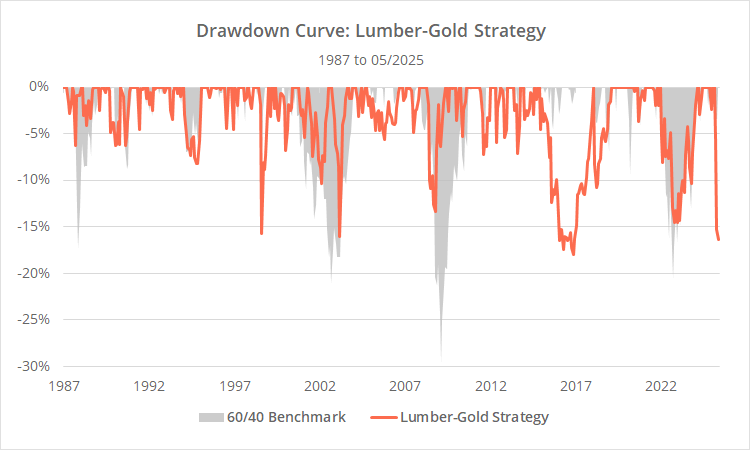

Strategy results from 1987 follow. Results are net of transaction costs – see backtest assumptions. Learn about what we do and follow 90+ asset allocation strategies like this one in near real-time.

Logarithmically-scaled. Click for linearly-scaled results.

This strategy trades frequently (by TAA standards), turning over the portfolio nearly 7x per year. That would have taken a big bite out of returns; roughly 1.5% per year based on our conservative trading cost assumption.

Strategy rules tested:

This is a weekly strategy. The results above assume trades were placed at the close on the last trading day of the week. Later in this analysis we’ll test execution on other days of the week as well.

-

At the close on the last trading day of the week, measure the 13-week return of lumber versus gold.Lumber return is based on the generic 1st LB future (Bloomberg ticker: LB1 COMB Comdty).

-

If lumber outperformed gold, allocate 100% of the portfolio to US stocks (represented by SPY) at the close, otherwise to US Treasuries (IEF).The authors offered multiple options for the risk asset. We’ve opted for the most general, SPY. Also, the authors assumed 5-7 year Treasuries (ex. IEI). We’ve assumed 7-10 year Treasuries (IEF), because that’s the intermediate-term UST we use throughout this platform. Results with IEI would not have been materially different than those presented here.

- Hold all positions until the end of the following week.

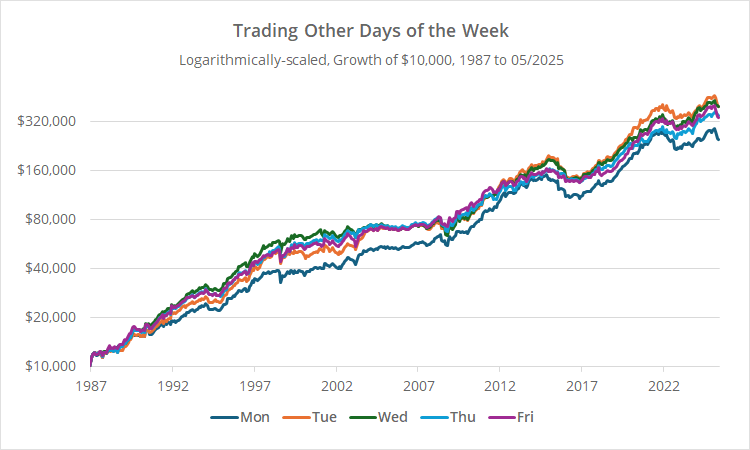

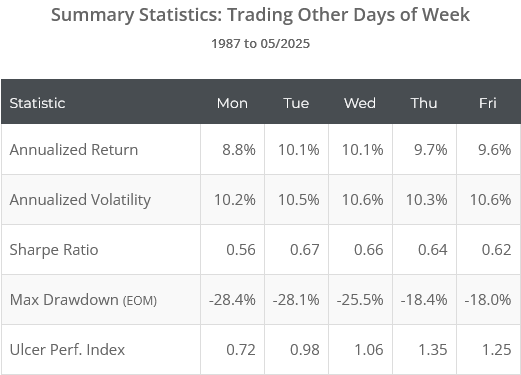

Trading on days other than end of week:

Below we show results of trading on days other than the end of the week. We’re not simply executing the existing signal at a later time. We’re recalculating the signal on each day. For Monday, we compare today to 13 Mondays prior, Tuesday to 13 Tuesdays prior, etc. Geek note: To normalize the days of the week, we use the same approach that we take with monthly strategies (learn more).

Mondays have stood out as the worst day to execute the strategy, but the difference is relatively small and could simply be the result of random chance.

Our take on the Lumber-Gold Strategy:

This is essentially a short-term momentum strategy, with lumber acting as a proxy for risk assets.

13-week lumber returns have been about 3x more volatile than gold, meaning the position taken each week is mostly driven by the price of lumber, not gold. The strategy would have performed similarly if it simply looked at whether the price of lumber was up or down over the last 13 weeks.

Readers know that, on principle, we’re proponents of combining strategies that employ diverse approaches to trading, including using some unique data source (like this strategy). In practice, however, lumber has proven to be an unreliable predictor post publication.

We’re sure there’s value in looking at the price of lumber as part of a more nuanced economic analysis, but it hasn’t performed well as a standalone indicator.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free membership. Put the industry’s best Tactical Asset Allocation strategies to the test, combine them into your own custom portfolio, and follow them in real-time. Learn more about what we do.