Tactical Asset Allocation (TAA) as a whole continues to weather the fallout well, significantly paring down losses versus a conventional buy & hold portfolio. Individual strategies vary widely.

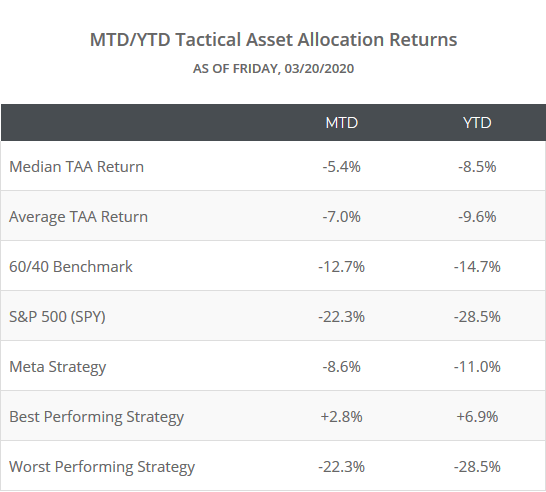

We track 50+ published TAA strategies, allowing us to draw some broad conclusions about TAA as a style. In the table below we show the MTD/YTD returns of these 50+ strategies as of Friday, 03/20:

How we got here: TAA began reducing exposure to risk assets back in January, and entered March allocated 76% to defensive assets like treasuries and gold (read more). That was “enough” through about 03/10, and most strategies were up/flat for the month. After that point however, even that large defensive position wasn’t sufficient to offset continued losses in risk assets. Treasury returns have since been tepid, and gold has dropped significantly.

As of Friday (03/20), 15 strategies were still up MTD, and 42 out of 54 strategies were outperforming the 60/40 benchmark. You never perform as well as you would like at times like this, but taken as a whole, TAA has served one of its two primary functions reasonably well: managing losses during the bad times (while keeping pace during the good times).

There’s a wide disparity in results though, as should be clear comparing the best and worst strategies in the table above. That highlights the importance of diversifying across strategies (something our platform is specifically designed to do). Going all in on a single strategy could have been devastating.

We should note these results only apply to DIY tactical asset allocation (i.e. the types of public strategies we track). Tactical ETFs have performed mostly terribly through this crisis. We don’t know why. Over complexity? Unable to turn portfolios over quickly enough relative to the speed of the crisis? We’ll share some data on this at month-end.

Our own Meta Strategy, while outperforming both buy & hold and most of those professional solutions, has underperformed the average strategy on our site. That’s disappointing. The reason: Meta is a combination of 10 individual strategies. We let Meta select those 10 strategies based on this approach. Because very active TAA had been pretty meh recently compared to this go-go market (where anything less than long risk to the gills has been suboptimal), the 10 strategies selected began gravitating towards less active, less skittish models. Unfortunately, this crisis called for the exact opposite approach. The more active strategies that were more quick to reduce risk outperformed, and Meta was holding too “slow” a portfolio. Expect more data on this at month-end.

TAA will likely reach peak defensiveness by the end of this month (read more). Based on where our Aggregate Asset Allocation report stands as of today, that’s looking like somewhere around a 90% allocation to defensive assets, more than half of which will be in int/long-term US Treasuries. Given recent volatility in yields, that could expose TAA to significant losses if we see a sharp recovery in risk assets. Obviously we’re in the early days of this crisis, and we won’t be able to judge TAA’s success or failure until the full cycle has played out.

A note on business continuity:

The two primary brains at Allocate Smartly are Walter (the guy writing this, who many of you have conversed with over the years) and John (who we keep in the dungeon).

Because by my nature I am risk averse and can work from anywhere, I temporarily relocated my family to Taiwan before this crisis hit. Taiwan has managed this situation better than just about anyone and we have family here, so it was an easy decision and an easy transition. John however is near the epicenter in NYC.

As long as one of us is up and running (along with our hosting provider and at least one of our redundant data providers), this site will function as expected. I expect myself to be fine. I’m in probably the safest place in the world right now. John is in the fire however, and I will continue to worry about him and pray for him daily.

Stay safe out there.