Allocate Smartly tests and tracks asset allocation strategies sourced from books, academic papers and other publications. Most of the strategies that we test though never make it on to this site. There are a variety of reasons that might be, but often it’s simply because they’re not very good. Usually we just let those strategies slip gently into the good night, but this one took a lot of work and is a novel idea, so we thought it worth sharing.

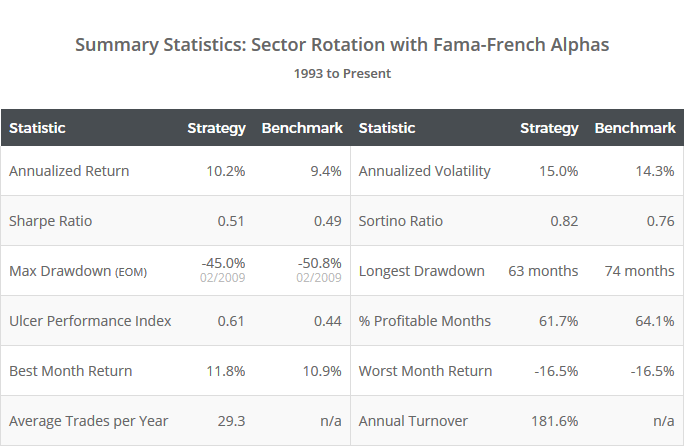

This strategy rotates among stock market sector ETFs based on Fama-French alphas. Strategy results from 1993 to the present, net of transaction costs, follow. Learn more about what we do.

Linearly-scaled. Click for logarithmically-scaled chart.

We’ve withheld the name of the paper that this strategy was sourced from, as we aim to only spread good cheer. Below we present a modified set of rules that are similar in spirt.

Strategy rules tested:

This strategy trades the 10 S&P Sector SPDR ETFs.

- At the close on the last trading day of the month, calculate each sector’s alpha from the Fama-French five factor model, based on the most recent 36 month-end values (*).

- Select all sectors with positive alpha and equal-weight them at the close. Hold all positions until the final trading day of the following month.

Alpha represents the portion of each sector’s return that cannot be explained by one of five “factors” like size, value vs growth, etc. Positive alpha indicates that the sector exhibits positive excess returns, which the authors postulate is indicative of future outperformance.

(*) Calculation note: The results shown here actually ignore the most recent two month-ends when calculating alphas in order to account for the delay in Fama-French releasing data. This change improved results and is more applicable to the real-world. Win-win.

Conclusions:

Is this sector rotation strategy better than the benchmark? Marginally perhaps, but not enough to justify trading it over other superior asset allocation strategies.

We could definitely improve upon these results with some simple trend-following mechanism for sidestepping those significant drawdowns, but that would really be a test of trend-following, not this factor model approach.

In short, factor alphas as defined here do not appear to have significant predictive ability for US stock market sectors.

We invite you to become a member for about $1 a day, or take our platform for a test drive with a free limited membership. Members can track the industry’s best tactical asset allocation strategies in near real-time, and combine them into custom portfolios. Have questions? Learn more about what we do, check out our FAQs or contact us.