We track a wide range of tactical asset allocation strategies in near real-time (41 and counting), which members can combine into their own custom portfolios. We provide members with a wealth of data to understand how each strategy fits into a coherent trading plan, but we don’t tell members the absolute “best” ones to trade or how to combine them. That’s because there isn’t a single best approach. The best is highly dependent on each investor’s unique needs.

What we do want to help members understand however is when they might be doing something that is clearly not the best. One such suboptimal approach we occasionally see members taking is frequently switching between TAA strategies based on recent “relative strength” (i.e. trading the strategies that have performed the best in the very recent past). For example, an investor might select the 3 strategies each month that have performed the best over the previous 6-months, or the 1 strategy that performed best last month.

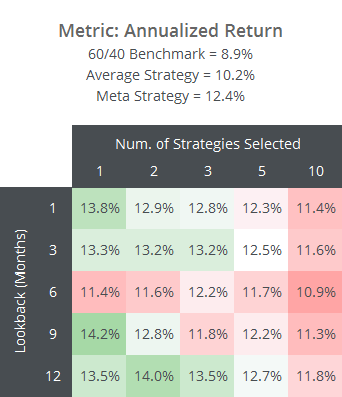

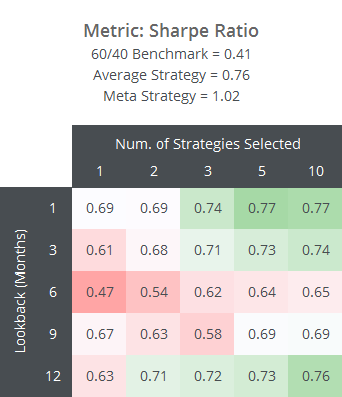

We can’t test every conceivable possibility, but below we’ve shown statistics that we think are representative of the concept. Here we’ve assumed an investor traded X strategies from our database each month (columns) with the highest return over the previous Y months (rows). Results are shown from 1973 to the present in terms of annualized return, Sharpe Ratio (return relative to volatility) and UPI (return relative to drawdowns). Results include transaction costs (read more about backtest assumptions).

Note: The “Meta Strategy” results included above are from our own smart approach to combining TAA strategies that we rolled out last month for members. Read more.

Key takeaways:

- All possible combinations were superior to the 60/40 benchmark, but that isn’t saying much. Given a long enough time horizon, nearly all of the strategies that we track have soundly outperformed the broader market.

- No combinations were better across all metrics than the average strategy that we track, and in many cases were much worse. In other words, the recent relative strength of strategies has provided little value as a timing indicator. A large part of that underperformance was due to the additional transaction costs incurred by frequently switching between strategies.

- Annualized returns when selecting a small number of strategies has been higher (regardless of lookback length) but that’s only because relative strength tends to select more volatile strategies. Volatile strategies will, by their nature, tend to be the top (and bottom) performers at any given time and will be selected more often. Investors looking for higher returns would likely be better served selecting volatile strategies full stop, regardless of recent relative strength.

There are infinite approaches an investor might take to measure the recent relative strength of strategies. These results were only meant to be illustrative, but from our own testing, the conclusion holds across other more complicated approaches. Investors should choose strategies based on their long-term strength and unique characteristics, not their very recent returns.

- This conclusion only applies to recent relative strength among TAA strategies. Relative strength among assets is a very useful approach that many of the strategies that we track employ.

- While selecting the recent top performing strategies may be suboptimal, selecting the worst recent performers has been even worse. Returns from picking recent losers were all well south of those presented above. As a result, there has been some value in avoiding the worst recent performers (not shown for brevity).

- Here we used a very simple measure of recent relative strength (returns over the previous n months). There are more sophisticated approaches, including adjusting returns for volatility or including both absolute and relative strength, but we would argue that all have been inferior to considering the long-term performance and unique characteristics of each strategy.

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolios, and then track them in near real-time. Have questions? Learn more about what we do, check out our FAQs or contact us.