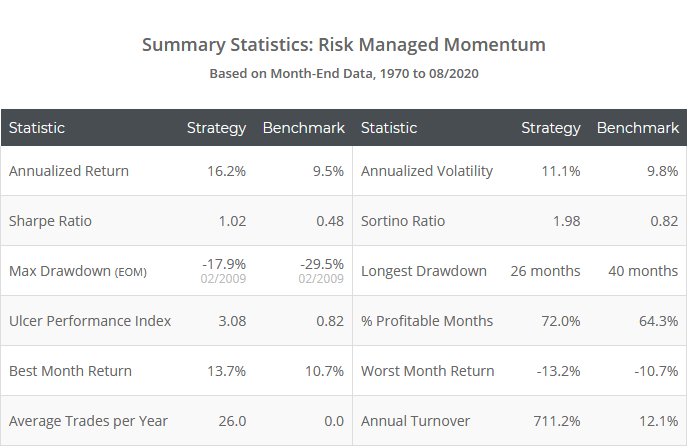

This is an independent test of Aspect Partners’ flagship tactical asset allocation strategy Risk Managed Momentum (RMM). By tactical standards, RMM is a very active, very aggressive strategy. It has done an excellent job navigating this difficult year so far.

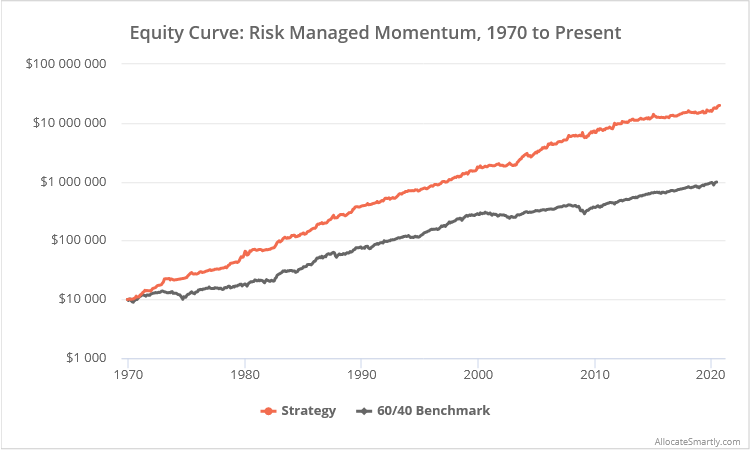

Backtested results from 1970 follow. Results are net of transaction costs (see backtest assumptions). Learn about what we do and follow RMM and 50+ other asset allocation strategies in near real-time.

Logarithmically-scaled. Click for linearly-scaled results.

About this strategy:

RMM trades once per month. It measures asset momentum across multiple long and short timeframes (why is that important?) but is heavily biased towards short-term momentum. That focus on short-term momentum means that RMM changes positions frequently. At 7x annual turnover, it’s the most active strategy on our platform.

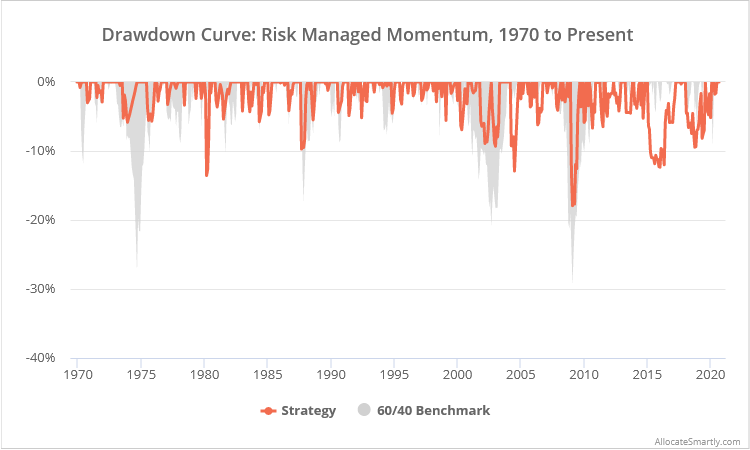

RMM is quick to move the entire portfolio to defensive assets when risk assets are showing even a small degree of weakness (similar to what VAA and others call “crash protection”). As a result, it has spent about half of all months 100% allocated to bonds/cash.

As the results above show, RMM been very successful in terms of both absolute and risk-adjusted performance, but a word of common sense: RMM takes aggressive positions. The strategy will at times (like this very moment) be entirely allocated to risk. It does not enforce a significant degree of diversification. Investors should strongly consider mixing RMM with other asset allocation strategies to better diversify short-term risk. That’s something out platform was specifically built to tackle.

Rules not disclosed at Aspect Partners’ request:

Unlike nearly every strategy that we track, we will not be disclosing the specific rules traded by RMM. Aspect Partners asked us to independently verify their results, and in exchange our members are able to follow along with the strategy like any other on our platform.

To be clear, we know the rules, and the data on our platform is based on our own independent analysis using the same rigorous approach you’ve come to expect from us. The rules are simply withheld from members.

This is the second black box strategy we track (the other being Paul Novell’s SPY-COMP). The majority of members only care about end results, but there is a segment of our member base that is as nerdy as we are and want those detailed rules.

For those folks, RMM might not be for you (sorry). Luckily, we track 50+ other (fully-disclosed) asset allocation strategies, so there are lots of other good strategies to consider. When an established investment advisor allows us to replicate and track their flagship model, we’re always going to jump at that opportunity. For most of our users it’s a win. For everyone else, it’s a wash.

A note of common sense on YTD performance:

RMM is killing it this year with a 20.3% return (as of 09/16) and max drawdown of just -3.5%. As a result, we expect that it’s going to get a lot of attention from members.

A reminder: At least in the case of TAA strategies, strong recent performance is a bad predictor of near-term future performance. Read our previous analysis on the subject. RMM’s strong YTD performance doesn’t necessarily make it a bad time to jump into the strategy, but it also doesn’t necessarily make it a good time either.

A big thank you to Aspect Partners for the opportunity to put RMM to the test. Our approach to backtesting tends to be more conservative/strict (read: realistic) than you’ll find elsewhere, and it takes guts to turn your pride and joy over to an independent firm for a thorough once over.

New here?

We invite you to become a member for about a $1 a day, or take our platform for a test drive with a free limited membership. Put the industry’s best tactical asset allocation strategies to the test, combine them into your own custom portfolio, and follow them in near real-time. Not a DIY investor? There’s also a managed solution. Learn more about what we do.

Calculation notes:

The results shown on our platform may not match those presented by Aspect Partners. While we’ve maintained the spirit of the strategy, we deviated from their rules in order to fit the standardized approach we take on this site: (1) We assume trades were executed at the month-end close, (2) we use DBC in place of GSG to represent diversified commodities (read why), (3) we assume any allocation to SHY (short-term UST ETF) is instead placed in cash (represented by 13-week UST) as it’s more relevant to today’s low interest rate environment, and (4) we make a number of backtest assumptions including for transaction costs.